SBA Bankers Discussed New Small Business Aid at Jan. 26 GABB Meeting

Bankers with expertise in handling SBA loans talked about applying for the next round of Paycheck Protection Program (PPP) funding at the Jan. 26 virtual meeting of the Georgia Association of Business Brokers.

A recording of the meeting is linked here.

GABB Affiliate Representative Kim Eells , Senior Vice President of SBA Business Development at Georgia Primary Bank, spoke along with Thomas Rockwood, Senior Vice President of SBA Lending at Atlantic Capital Bank and Cadence Bank Vice President and SBA Banker Ryan Stoll.

Here’s some PPP background from Kim Eells’ bank, Georgia Primary.

Thomas Rockwood’s bank, Atlantic Capital’s link, has this information.

Ryan Stoll’s bank, Cadence Bank, has posted this information.

SBA links to various Coronavirus Relief Options.

The Paycheck Protection Program (PPP) reopened the week of January 11 for new borrowers and certain existing PPP borrowers, according to the U.S. Small Business Association. This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan, the SBA says.

PPPSD Revenue Reduction Documentation_2021_01_19

The SBA says a borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

Has no more than 300 employees; and - Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

- The GABB is the state’s premier organization devoted to buying and selling businesses and franchises, and operates the state’s only real estate school dedicated to business brokering.

For more information about GABB, please email diane.loupe@gabb.org or call or text 770-744-3639, or contact GABB president Judy Mims at judy@childcare.properties or 404-842-1997.

Read MoreSBA and Treasury Announce PPP Re-Opening; Issue New Guidance

SBA and Treasury Announce PPP Re-Opening; Issue New Guidance

The U.S. Small Business Administration, in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers.

To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13.

The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act. The SBA also extended the deadline to apply for the Economic Injury Disaster Loan (EIDL) program for the COVID-19 Pandemic disaster declaration to December 31, 2021.

This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan.

SBA Administrator Jovita Carranza

“The historically successful Paycheck Protection Program served as an economic lifeline to millions of small businesses and their employees when they needed it most,” said SBA Administrator Jovita Carranza. “Today’s guidance builds on the success of the program and adapts to the changing needs of small business owners by providing targeted relief and a simpler forgiveness process to ensure their path to recovery.”

US Treasury Secretary Steven Mnuchin

“The Paycheck Protection Program has successfully provided 5.2 million loans worth $525 billion to America’s small businesses, supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin. “This updated guidance enhances the PPP’s targeted relief to small businesses most impacted by COVID-19. We are committed to implementing this round of PPP quickly to continue supporting American small businesses and their workers.”

Key PPP updates include:

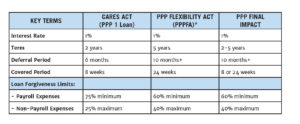

- PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

- PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

- The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, destination marketing organizations, among other types of organizations;

- The PPP provides greater flexibility for seasonal employees;

- Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

- Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

- A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

- Has no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

- PPP Guidance from SBA Administrator Carranza on Accessing Capital for Minority, Underserved, Veteran, and Women-owned Business Concerns;

- Interim Final Rule on Paycheck Protection Program as Amended by Economic Aid Act; and

- Interim Final Rule on Second Draw PPP Loans

For more information on SBA’s assistance to small businesses, visit sba.gov/ppp or treasury.gov/cares.

SBA Georgia District Office

233 Peachtree Street NE, Suite #300

Atlanta, GA 30303

Phone: (404) 331-0100

www.sba.gov/ga

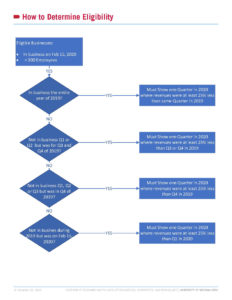

How To Determine Eligibility for Economic Aid

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. This information is provided by the UGA Small Business Development Center, which will continue to update their information as the approval process progresses and s and the SBA releases guidelines.

How to Determine Eligibility for Economic Aid:

Economic Aid to Hard-Hit Small Businesses: Overview

OVERVIEW: Provided by the UGA Small Business Development Center

ECONOMIC AID TO HARD-HIT SMALL BUSINESSES, NONPROFITS AND VENUES ACT

CURRENT STATUS: Signed into Law on 12/27/2020

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by

COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. We will continue to update this document as the approval process progresses and the SBA releases guidelines.

Key Components of the Act

- Second Draw of Paycheck Protection Program Loan (PPP2)

- Targeted COVID-19 Economic Injury Disaster Loan (EIDL) Advance

- SBA Guaranteed Loan Debt Relief

- Targeted Programs for:

- Hardest Hit Businesses

- Disadvantaged Businesses

- Resolves tax treatment of PPP Forgiveness and Debt Relief Payment

Second Draw of Paycheck Protection Program (PPP2)

Eligible Businesses:

- Must have experienced at least one quarter in 2020 with revenues >25% below corresponding 2019 quarter

- No more than 300 employees

- Must have or will use full amount of initial PPP loan funds (PPP1)

- Same business types as qualified for initial PPP loans

- Had to be in business on February 15, 2020

Loan limit of $2M and $10 if combined with PPP1, based on:

- 5X average monthly 2019 payroll (same as PPP1)

- 5X if you’re a business with a NAICS Code beginning in 72

• Additional Eligible Expenses:

- Operations Expenditures – software, cloud computing, HR and accounting expenses

- Property Damage Costs – repair expenses due to public disturbances not covered by your insurance

- Supplier Costs – supplier costs essential to your business

- Worker Protection Expenditure – cost incurred to protect workers from COVID-19

- Employer Provided Group Insurance – can be included as payroll costs

• Can request an increase in PPP1 loan if SBA updated regulations would have allowed it (e.g. Owner’s Draw)

• Seasonal Employer

- Operates for no more than seven months in a year

- Earned no more than 1/3 of its receipts in any six month period during prior calendar year

- Can use highest 12 consecutive weeks of payroll between 2/15/2019 and 2/15/2020 to calculate loan size

• 501(c)(6) now eligible – cannot have more than 15% of its revenue from lobbying efforts

• Loans available through March 31, 2021

• For loans under $150k – forgiveness application is now a one-page certification that identifies:

- Number of employees you were able to retain

- Estimate of amount spent on payroll

- Total loan amount

• Must attest to the use of funds for allowable expenses only

• SBA will issue this form within 24 days of enactment

• Emergency EIDL grants extended through Dec. 31, 2021.

- Repeals the EIDL Advance Deduction from forgiveness (those already forgiven will be ‘made whole’)

• Targeted Advances to eligible entities:

- “Grosses-up” the difference between what was granted earlier and $10k

- Provides $10k grant to those who did not get grants because funding had run out

• To qualify for the full $10,000 EIDL grant, a business must:

- Be located in a low-income community, and

- Have suffered an economic loss greater than 30%, and

- Employ no more than 300

• In addition, the business must qualify as an eligible entity as defined in the CARES Act:

- A small business, cooperative, ESOP Tribal concern, with fewer than 300 employees

- An individual who operates under as a sole proprietorship, with or without employees, or as an independent contractor; or a private non-profit or small agricultural

- The business must have been in operation by January 31,

- The business must be directly affected by COVID-19.

- ECONOMIC LOSS —The term ‘‘economic loss’’ means, with respect to a covered entity—

- (A) the amount by which the gross receipts of the covered entity declined during an 8-week period between March 2, 2020, and December 31, 2021, relative to a comparable 8-week period immediately preceding March 2, 2020, or during 2019; or

- (B) if the covered entity is a seasonal business concern, such other amount determined appropriate by the Administrator.

SBA Guaranteed Loan Debt Relief

• Pays an additional 3 months of principal and interest (P&I) on existing 7(a), 504 and Microloans

- Begins in February 2021 – capped at $9,000 per month

- After 3 months – businesses with selected NAICS codes will receive an additional 5 months of P&I payments – capped at $9000 per month

- Designated NAICS Codes beginning in: 61, 71, 72, 213, 315, 448, 451, 481, 485, 511, 512, 515, 531, or 812

• Pays 6 months of P&I for any new SBA guaranteed loans approved before Sept. 30, 2021.

- Plus 3 months after first 6 months of payments

- Plus 5 months if you have a qualifying NAICS Code

• Improvements have been made to the SBA 7(a) program

- Increased SBA guarantee level to 90%

- Reduced or eliminated some fees

$15B for SBA grants to:

- Theatrical producers and talent representatives

- Operators of:

- Live venues

- Live performing arts organizations

- Museums

- Independent motion picture theatres

- Must demonstrate a 25% reduction in revenue

- Can be up to $10 million dollars with a potential supplement of 50%

- $2B is set-aside for those with less than 50 employees

Timing of Grants:

- In the initial 14 days, grants will be exclusively made to those with 90% or greater revenue loss

- In the second 14 days, grants will be to those with 70% or greater revenue loss

- After these two rounds – all other qualifying entities will receive awards

- NOTE – if you receive a grant, you cannot participate in PPP2

Focus on Disadvantaged Businesses

- $15B is set aside for Community Development Financial Institutions (CDFI) and Minority Depository Institutions (MDI)

- Programs Targeted at Specific Business Segments

- Child Care Providers

- Transportation Providers

- Rental Assistance

Resolution of Tax Issues

- Expenses paid by PPP funds can be claimed as business expenses

- Resolves the IRS and Treasury guidance that this would constitute ‘double-dipping’ and they couldn’t be used as business expenses

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Debt relief payment of P&I will not be treated as income

- Reverses recent guidance that required lenders to issue 1099 forms to borrowers benefiting from this program

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Pull together your financial information and be ready when bank portals

- The information needed is nearly identical to what you did for

For updated information:

- Watch for SBA and Treasury guidance – our website is a good source of information https://www.georgiasbdc.org

- We have additional webinar opportunities coming up and an on-demand https://www.georgiasbdc.org/2nd-round-covid-funding-webinars/

Next Steps

• Review your options as listed in this document.

- Contact your local UGA SBDC office to speak with a business consultant. There are 18 offices located throughout Georgia, serving every During this time, consultants are available via phone, email or video-conference only.

• Your business consultant will be able to answer any questions you may have. He/she will be available to assist you as you navigate the application process.

ABOUT THE UGA SBDC

The UGA Small Business Development Center (SBDC) provides tools, training and resources to help small businesses grow and succeed.

Designated as one of Georgia’s top providers of small business assistance, the UGA SBDC has 18 offices to serve the needs of Georgia’s business community.

ALBANY 229-420-1144

ATHENS 706-542-7436

GEORGIA STATE UNIVERSITY 404-413-7830

AUGUSTA 706-650-5655

BRUNSWICK 912-264-7343

UNIVERSITY OF WEST GEORGIA 678-839-5082

COLUMBUS 706-569-2651

DEKALB 770-414-3110

GAINESVILLE 770-531-5681

GWINNETT 678-985-6820

KENNESAW STATE UNIVERSITY 470-578-6450

MACON 478-757-3609

MOREHOUSE COLLEGE 470-268-5793

CLAYTON STATE UNIVERSITY 678-466-5100

ROME 706-622-2006

SAVANNAH 912-651-3200

GEORGIA SOUTHERN UNIVERSITY

912-478-7232

VALDOSTA STATE UNIVERSITY 229-245-3738

The University of Georgia SBDC is a Public Service and Outreach unit of the University of Georgia, funded in part through a cooperative agreement with the U.S. Small Business Administration.

Read MoreGuidelines on PPP Loans When Selling a Business

Kim Eells, Senior Vice President and Small Business Administration (SBA) Business Development Officer for Georgia Primary Bank.

Kim Eells, Senior Vice President and Small Business Administration (SBA) Business Development Officer for Georgia Primary Bank, discussed new SBA guidelines on dealing with Paycheck Protection Program loans when selling a business at the Nov. 10 GABB meeting. Kim is an Affiliate Board member of GABB.

The SBA issued guidelines on Oct. 2 that provide a framework to determine whether SBA consent is necessary when selling a business or other entity that has received PPP funds.

Listen to an audio recording of Ms. Eells’ remarks at this link.

She recommended that sellers with PPP loans should ask forgiveness, a process that could take up to five months, but in practice usually takes less time. The SBA is also issuing a new form, 3508s which will make it easier for entities with PPP loans under $50,000 to apply for forgiveness.

If a business has an EIDL loan, she recommends postponing an application for PPP forgiveness.

GABB Affiliate attorney Wendy Kraby said that for the sale of a business with an SBA loan, “I am seeing the banks want to see very specific language in the Purchase Agreements detailing the requirement of an Escrow Account. The bank then wants to see that Agreement (before it is signed) to make sure it meets the bank’s requirements. Because of this, it is very important to contact the bank at the very beginning of planning for sale AND before a PSA is signed.”

Ms. Kraby described a typical provision to handle a PPP loan in a Purchase Agreement. “The Seller has taken out a Paycheck Protection Program loan in the amount of $______________with XXX Bank. Seller has completed and submitted a PPP Forgiveness Application along with all supporting documentation. At Closing, Seller shall deposit into an Interest Bearing Escrow Account controlled by XXX Bank Corporation an amount equal to the outstanding balance of the PPP loan pursuant to the Escrow Agreement, attached hereto as Exhibit “D.”

The Georgia Association of Business Brokers, or GABB, is the state’s premier organization devoted to buying and selling businesses and franchises, and operates the state’s only real estate school dedicated to business brokering. For more information about GABB, please email diane.loupe@gabb.org, call or text 404-374-3990.

“The PPP has provided 5.2 million loans worth $525 billion to American small businesses, providing critical economic relief and supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin in a press release.

The SBA specifies that “There are different procedures depending on the circumstances of the change of ownership, as set forth below. In all cases, the PPP Lender is required to continue submitting the monthly 1502 reports until the PPP loan is fully satisfied.”

- 1.The PPP Note is fully satisfied. There are no restrictions on a change of ownership if, prior to closing the sale or transfer, the PPP borrower has:

- Repaid the PPP Note in full; or

- Completed the loan forgiveness process in accordance with the PPP requirements and:

- SBA has remitted funds to the PPP Lender in full satisfaction of the PPP Note; or

- The PPP borrower has repaid any remaining balance on the PPP

- The PPP Note is not fully satisfied. If the PPP Note is not fully satisfied prior to closing the sale or transfer, the following applies:

- Cases in which SBA prior approval is not required. If the following conditions are met for (i) a change of ownership structured as a sale or other transfer of common stock or other ownership interest or as a merger; or (ii) a change of ownership structured as an asset sale, the PPP Lender may approve the change of ownership and SBA’s prior approval is not required:

- Change of ownership is structured as a sale or other transfer of common stock or other ownership interest or as a merger. An individual or entity may sell or otherwise transfer common stock or other ownership interest in a PPP borrower without the prior approval of SBA only if:

- A. The sale or other transfer is of 50% or less of the common stock or other ownership interest of the PPP borrower3; or

- B. The PPP borrower completes a forgiveness application reflecting its use of all of the PPP loan proceeds and submits it, together with any required supporting documentation, to the PPP Lender, and an interest-bearing escrow account controlled by the PPP Lender is established with funds equal to the outstanding balance of the PPP loan. After the forgiveness process (including any appeal of SBA’s decision) is completed, the escrow funds must be disbursed first to repay any remaining PPP loan balance plus interest.

- In any of the circumstances described in a) or b) above, the procedures described in paragraph #2.c. below must also be followed.

- Change of ownership is structured as an asset sale. A PPP borrower may sell 50 percent or more of its assets (measured by fair market value) without the prior approval of SBA only if the PPP borrower completes a forgiveness application reflecting its use of all of the PPP loan proceeds and submits it, together with any required supporting documentation, to the PPP Lender, and an interest-bearing escrow account controlled by the PPP Lender is established with funds equal to the outstanding balance of the PPP loan. After the forgiveness process (including any appeal of SBA’s decision) is completed, the escrow funds must be disbursed first to repay any remaining PPP loan balance plus interest. The PPP Lender must notify the appropriate SBA Loan Servicing Center of the location of, and the amount of funds in, the escrow account within 5 business days of completion of the transaction.

- Cases in which SBA prior approval is required. If a change of ownership of a PPP borrower does not meet the conditions in paragraph #2.a. above, prior SBA approval of the change of ownership is required and the PPP Lender may not unilaterally approve the change of ownership.

To obtain SBA’s prior approval of requests for changes of ownership, the PPP Lender must submit the request to the appropriate SBA Loan Servicing Center. The request must include:- the reason that the PPP borrower cannot fully satisfy the PPP Note as described in paragraph #1 above or escrow funds as described in paragraph #2.a above;

- the details of the requested transaction;

- a copy of the executed PPP Note;

- any letter of intent and the purchase or sale agreement setting forth the responsibilities of the PPP borrower, seller (if different from the PPP borrower), and buyer;

- disclosure of whether the buyer has an existing PPP loan and, if so, the SBA loan number; and

- a list of all owners of 20 percent or more of the purchasing entity.

If deemed appropriate, SBA may require additional risk mitigation measures as a condition of its approval of the transaction.

SBA approval of any change of ownership involving the sale of 50 percent or more of the assets (measured by fair market value) of a PPP borrower will be conditioned on the purchasing entity assuming all of the PPP borrower’s obligations under the PPP loan, including responsibility for compliance with the PPP loan terms. In such cases, the purchase or sale agreement must include appropriate language regarding the assumption of the PPP borrower’s obligations under the PPP loan by the purchasing person or entity, or a separate assumption agreement must be submitted to SBA.

SBA will review and provide a determination within 60 calendar days of receipt of a complete request.

- For all sales or other transfers of common stock or other ownership interest or mergers, whether or not the sale requires SBA’s prior approval. In the event of a sale or other transfer of common stock or other ownership interest in the PPP borrower, or a merger of the PPP borrower with or into another entity, the PPP borrower (and, in the event of a merger of the PPP borrower into another entity, the successor to the PPP borrower) will remain subject to all obligations under the PPP loan. In addition, if the new owner(s) use PPP funds for unauthorized purposes, SBA will have recourse against the owner(s) for the unauthorized use.If any of the new owners or the successor arising from such a transaction has a separate PPP loan, then, following consummation of the transaction: (1) in the case of a purchase or other transfer of common stock or other ownership interest, the PPP borrower and the new owner(s) are responsible for segregating and delineating PPP funds and expenses and providing documentation to demonstrate compliance with PPP requirements by each PPP borrower, and (2) in the case of a merger, the successor is responsible for segregating and delineating PPP funds and expenses and providing documentation to demonstrate compliance with PPP requirements with respect to both PPP loans.The PPP Lender must notify the appropriate SBA Loan Servicing Center, within 5 business days of completion of the transaction, of the:

- identity of the new owner(s) of the common stock or other ownership interest;

- new owner(s)’ ownership percentage(s);

- tax identification number(s) for any owner(s) holding 20 percent or more of the equity in the business; and

- location of, and the amount of funds in, the escrow account under the control of the PPP Lender, if an escrow account is required.

PPP Loans Pledged in Paycheck Protection Program Liquidity Facility (PPPLF)

If a PPP loan of a PPP borrower associated with a change of ownership transaction was pledged by the PPP lender to secure a loan under the Federal Reserve’s PPPLF, the lender is reminded to comply with any notification or other requirements of the PPPLF.

SBA Procedural Notice: SBA PPP Loans and Change of Ownership

The Georgia Association of Business Brokers, or GABB, is the state’s premier organization devoted to buying and selling businesses and franchises, and operates the state’s only real estate school dedicated to business brokering. For more information about GABB, please email diane.loupe@gabb.org, call or text 404-374-3990, or contact GABB president Dean Burnette at dean@b3brokers.com or (912) 247-3209.

Read More