Economic Aid to Hard-Hit Small Businesses: Overview

OVERVIEW: Provided by the UGA Small Business Development Center

ECONOMIC AID TO HARD-HIT SMALL BUSINESSES, NONPROFITS AND VENUES ACT

CURRENT STATUS: Signed into Law on 12/27/2020

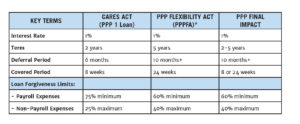

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by

COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. We will continue to update this document as the approval process progresses and the SBA releases guidelines.

Key Components of the Act

- Second Draw of Paycheck Protection Program Loan (PPP2)

- Targeted COVID-19 Economic Injury Disaster Loan (EIDL) Advance

- SBA Guaranteed Loan Debt Relief

- Targeted Programs for:

- Hardest Hit Businesses

- Disadvantaged Businesses

- Resolves tax treatment of PPP Forgiveness and Debt Relief Payment

Second Draw of Paycheck Protection Program (PPP2)

Eligible Businesses:

- Must have experienced at least one quarter in 2020 with revenues >25% below corresponding 2019 quarter

- No more than 300 employees

- Must have or will use full amount of initial PPP loan funds (PPP1)

- Same business types as qualified for initial PPP loans

- Had to be in business on February 15, 2020

Loan limit of $2M and $10 if combined with PPP1, based on:

- 5X average monthly 2019 payroll (same as PPP1)

- 5X if you’re a business with a NAICS Code beginning in 72

• Additional Eligible Expenses:

- Operations Expenditures – software, cloud computing, HR and accounting expenses

- Property Damage Costs – repair expenses due to public disturbances not covered by your insurance

- Supplier Costs – supplier costs essential to your business

- Worker Protection Expenditure – cost incurred to protect workers from COVID-19

- Employer Provided Group Insurance – can be included as payroll costs

• Can request an increase in PPP1 loan if SBA updated regulations would have allowed it (e.g. Owner’s Draw)

• Seasonal Employer

- Operates for no more than seven months in a year

- Earned no more than 1/3 of its receipts in any six month period during prior calendar year

- Can use highest 12 consecutive weeks of payroll between 2/15/2019 and 2/15/2020 to calculate loan size

• 501(c)(6) now eligible – cannot have more than 15% of its revenue from lobbying efforts

• Loans available through March 31, 2021

• For loans under $150k – forgiveness application is now a one-page certification that identifies:

- Number of employees you were able to retain

- Estimate of amount spent on payroll

- Total loan amount

• Must attest to the use of funds for allowable expenses only

• SBA will issue this form within 24 days of enactment

• Emergency EIDL grants extended through Dec. 31, 2021.

- Repeals the EIDL Advance Deduction from forgiveness (those already forgiven will be ‘made whole’)

• Targeted Advances to eligible entities:

- “Grosses-up” the difference between what was granted earlier and $10k

- Provides $10k grant to those who did not get grants because funding had run out

• To qualify for the full $10,000 EIDL grant, a business must:

- Be located in a low-income community, and

- Have suffered an economic loss greater than 30%, and

- Employ no more than 300

• In addition, the business must qualify as an eligible entity as defined in the CARES Act:

- A small business, cooperative, ESOP Tribal concern, with fewer than 300 employees

- An individual who operates under as a sole proprietorship, with or without employees, or as an independent contractor; or a private non-profit or small agricultural

- The business must have been in operation by January 31,

- The business must be directly affected by COVID-19.

- ECONOMIC LOSS —The term ‘‘economic loss’’ means, with respect to a covered entity—

- (A) the amount by which the gross receipts of the covered entity declined during an 8-week period between March 2, 2020, and December 31, 2021, relative to a comparable 8-week period immediately preceding March 2, 2020, or during 2019; or

- (B) if the covered entity is a seasonal business concern, such other amount determined appropriate by the Administrator.

SBA Guaranteed Loan Debt Relief

• Pays an additional 3 months of principal and interest (P&I) on existing 7(a), 504 and Microloans

- Begins in February 2021 – capped at $9,000 per month

- After 3 months – businesses with selected NAICS codes will receive an additional 5 months of P&I payments – capped at $9000 per month

- Designated NAICS Codes beginning in: 61, 71, 72, 213, 315, 448, 451, 481, 485, 511, 512, 515, 531, or 812

• Pays 6 months of P&I for any new SBA guaranteed loans approved before Sept. 30, 2021.

- Plus 3 months after first 6 months of payments

- Plus 5 months if you have a qualifying NAICS Code

• Improvements have been made to the SBA 7(a) program

- Increased SBA guarantee level to 90%

- Reduced or eliminated some fees

$15B for SBA grants to:

- Theatrical producers and talent representatives

- Operators of:

- Live venues

- Live performing arts organizations

- Museums

- Independent motion picture theatres

- Must demonstrate a 25% reduction in revenue

- Can be up to $10 million dollars with a potential supplement of 50%

- $2B is set-aside for those with less than 50 employees

Timing of Grants:

- In the initial 14 days, grants will be exclusively made to those with 90% or greater revenue loss

- In the second 14 days, grants will be to those with 70% or greater revenue loss

- After these two rounds – all other qualifying entities will receive awards

- NOTE – if you receive a grant, you cannot participate in PPP2

Focus on Disadvantaged Businesses

- $15B is set aside for Community Development Financial Institutions (CDFI) and Minority Depository Institutions (MDI)

- Programs Targeted at Specific Business Segments

- Child Care Providers

- Transportation Providers

- Rental Assistance

Resolution of Tax Issues

- Expenses paid by PPP funds can be claimed as business expenses

- Resolves the IRS and Treasury guidance that this would constitute ‘double-dipping’ and they couldn’t be used as business expenses

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Debt relief payment of P&I will not be treated as income

- Reverses recent guidance that required lenders to issue 1099 forms to borrowers benefiting from this program

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Pull together your financial information and be ready when bank portals

- The information needed is nearly identical to what you did for

For updated information:

- Watch for SBA and Treasury guidance – our website is a good source of information https://www.georgiasbdc.org

- We have additional webinar opportunities coming up and an on-demand https://www.georgiasbdc.org/2nd-round-covid-funding-webinars/

Next Steps

• Review your options as listed in this document.

- Contact your local UGA SBDC office to speak with a business consultant. There are 18 offices located throughout Georgia, serving every During this time, consultants are available via phone, email or video-conference only.

• Your business consultant will be able to answer any questions you may have. He/she will be available to assist you as you navigate the application process.

ABOUT THE UGA SBDC

The UGA Small Business Development Center (SBDC) provides tools, training and resources to help small businesses grow and succeed.

Designated as one of Georgia’s top providers of small business assistance, the UGA SBDC has 18 offices to serve the needs of Georgia’s business community.

ALBANY 229-420-1144

ATHENS 706-542-7436

GEORGIA STATE UNIVERSITY 404-413-7830

AUGUSTA 706-650-5655

BRUNSWICK 912-264-7343

UNIVERSITY OF WEST GEORGIA 678-839-5082

COLUMBUS 706-569-2651

DEKALB 770-414-3110

GAINESVILLE 770-531-5681

GWINNETT 678-985-6820

KENNESAW STATE UNIVERSITY 470-578-6450

MACON 478-757-3609

MOREHOUSE COLLEGE 470-268-5793

CLAYTON STATE UNIVERSITY 678-466-5100

ROME 706-622-2006

SAVANNAH 912-651-3200

GEORGIA SOUTHERN UNIVERSITY

912-478-7232

VALDOSTA STATE UNIVERSITY 229-245-3738

The University of Georgia SBDC is a Public Service and Outreach unit of the University of Georgia, funded in part through a cooperative agreement with the U.S. Small Business Administration.