The Silver Lining in the Coronavirus: Think Positive!

Photo by Skitterphoto from Pexels

By Dean Burnette, GABB President and managing broker of Best Business Brokers of Savannah

In the last few days my email has had a growing amount of Covid-19 Update emails! When I turn the television or radio on I hear or see “Corona virus” 100’s of times. Although coverage of a global pandemic is understandable, we’re only human.

If exposure to the virus doesn’t get us, hearing bad news may.

Being an eternal optimist with real life experience through several world economic cycles, including the oil embargo of the 1970’s and 1980’s, The Y-2-K threat of 2000, the real estate bubble, I’m quite confident that most of us will survive this. In fact, some will prosper and some will not.

There will be short term challenges. I have been personally impacted by the current travel challenges. One buyer was supposed to fly in from Chicago last week to look at a business, another client was supposed to fly down from Ohio, and they both had to cancel. I’m expecting a buyer from New York to fly into Savannah Saturday morning, and I’m wondering if he will actually make it?

Some will be impacted more than others; I hope we will be compassionate and aware of other’s struggles. As in the past, most people will come out the other side of this challenge better than they imagined. In each of these cycles, new industries were created!

New industries will be created; some will become obsolete.

We’ve all learned a new term with Covid-19, Social Distancing. I’ve long said that there are some people you have to love from a distance, and social distancing certainly puts a new spin on that! The world may never be the same again.

I am over 60, and so I am at a higher risk than the general population and should take extra precautions. With all the technological advances in communication and social media, I don’t know whether to feel safer or more vulnerable with my higher risk senior status. But I do know that in every crisis, there are possibilities, a silver lining in a rain cloud.

The positive side of the Covid-19 experience

This too shall pass and probably sooner than we imagine! The world is much better equipped to overcome pandemics and other challenges that come at us. We are currently witnessing in real time the wonders of technology and the benefits we have in this day and time.

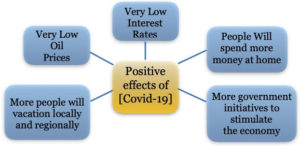

Instead of dwelling on the negative aspects of our current world challenges, we can find the silver lining. For example, I have two clients who have been able to secure business loans because of the lowered interest rates. After being cooped up for a couple of weeks or longer I believe people will fill up their gas tanks with cheap gas and travel locally, spend money in small businesses. I hope we can use this time of solitude to appreciate our families more and get some of those closets, garages, or spring cleaning done.

Opportunities will emerge

Other bright spots:

Other bright spots:

- Gasoline prices are very low.

- Interest rates are at historic lows, creating many opportunities for economic growth through new manufacturing opportunities and business expansion.

- Instead of going on cruises and traveling to other countries, people will fill up their tanks and spend their money locally in small businesses. More people will drive to Savannah or visit the Atlanta Aquarium!

- Many companies are encouraging people to work from home during the crisis, and after the crisis many will continue working from home.

- We all have learned the best way to wash our hands, and we’re washing more frequently, and most of us will be more aware of our health and hygiene.

- Because of our new awareness of how much we depend on foreign companies for vital products, more manufacturing will be done here.

- New industries will be created and more jobs and business opportunities will result from this crisis.

If you have been considering buying or selling a business, the stars are lining up, interest rates are low, and the U.S. government will be putting extra efforts into economic stimulus. Gas prices are very low, and people will have more money to spend in local businesses. The list goes on. If you have been waiting for the right time to buy or sell a business, that time is now. It sometimes takes months to close a deal, by that time the virus will be history, and businesses will beginning to flourish again!

Read More

Compiling an Offering Memorandum: What Buyers Look For

Steve Mariani spoke to the GABB on Feb. 19, 2020. Photo by Roger Easley.

Stephen “Steve” Mariani, owner of Diamond Financial Services and a board member of the International Business Brokers Association (IBBA), spoke to business brokers this week about compiling a listing or offering memorandum.

In a lively talk, which you can hear online, Mariani talked about the top things that buyers look for in a business-for-sale listing, and what lenders look for in an offering memorandum, a detailed description of a business for sale.Buyers are also interested in the location of a business as well as whether there is growth potential in the industry, Mariani said. Financing options, especially owner financing, are very important.

After the price of the business, most buyers will want to know about its cash flow and seller’s discretionary earnings. While it may be common to have family members on the payroll, claiming a personal home mortgage as a business expense is likely to attract unwanted scrutiny from lenders. And lenders are required by law to report instances of flagrant tax fraud, he said.

Listings that go through the effort to be pre-qualified by lenders, or eligible for SBA loans, are automatically more attractive to buyers, Mariani said. That means an objective professional has examined the business’s financials and brings “immediate confidence in the numbers presented.”

“If the listing can service the debt at the asking price, then cash flow after debt service becomes apparent to a potential buyer,” Mariani told the brokers. “Most buyers understand this and calculate it for themselves.”

Today’s borrowers are learning that they can purchase much more cash flow than they once thought, he said. Most high net worth borrowers are looking to maximize their ROI by using financing options. In Mr. Mariani’s PowerPoint Presentation: Compiling Offering Memoranda, he covered items every lender will look for, including purchase price, working capital, SBA fees and closing costs, etc. The GABB, an IBBA affiliate, is the state’s premier organization dedicated to professionals who buy and sell businesses in Georgia.

What three things should be left OUT of your offering document? Avoid listing specific qualifications a potential buyer must have to purchase the business, because this could scuttle a sale, Steve said. Although most lenders like to see three years of direct or one year of related experience in a field, this varies greatly.

Avoid listing personal add backs. If more than 20 percent of the seller’s discretionary earnings comes from personal add backs, the lender will be concerned.

Designating anyone at the business as a “key” employee, i.e., one that is critical to the operation and success of the business, raises a lot of red flags, may necessitate a form 1919 or a “required” personal guarantee of the employee, Mr. Mariani said.

Mr. Mariani’s company has helped small business owners realize their dreams by funding more than $1 billion in acquisition loans during the past 24 years. Diamond has become the nation’s largest privately owned non-bank SBA acquisition loan generator that serves only the broker markets. Steve has also been producing and presenting broker training webinars and workshops for the last 11 years at various conference events.

After witnessing the difficulty and challenges some business buyers experienced securing business loans to acquire a business, Mr. Mariani learned the intricate, complicated world of the Small Business Administration (SBA) loan process. He mastered the SBA SOP (Standard Operating Procedure) rules and regulations and has become a major source for many national lenders. Business Brokers, lenders and owners nationwide seek Steve’s advice and he has become the “expert” in SBA loans. His understanding of SBA rules also allows for providing the most aggressive financing available nationwide.

The GABB is the state’s largest and oldest association of professionals who specialize in brokering the purchase and sale of businesses and franchises. Broker members help owners determine the asking price of their business, create marketing plans and strategies for selling their business, identify and qualify buyers, and have the knowledge, experience and skills needed to help maintain the confidential nature of the process. The professionals of GABB relentlessly pursue professional development so they can provide superior, ethical services for all customers and clients. Affiliate members include bankers, lawyers, appraisers, insurers and other professionals who work closely with brokers to help owners and buyers get to the closing table.

For more information about GABB, please contact GABB President Dean Burnette at 912-247-3209 or dean@b3brokers.com, or GABB Executive Director Diane Loupe at diane@gabb.org or 404-374-3990.

Read MoreHow to Write an Effective Business-for-Sale Listing

Georgia Association of Business Brokers can now post business-for-sale listings on the new GABB website. But, as BizBuySell points out, it’s important to create a well-written online listing. You want to attract qualified buyers. According to BizBuySell’s latest demographic survey, business buyers tend to be college educated and earn over $100,000 per year. Buyers are more likely to respond to listings with these specific attributes, according to the website.

1. Specify a location.

Most buyers search for a business by state, many by a specific county. Confidential listings receive more views when they included a location.

2. The listing appears in their search category.

More than a third of prospective business buyers search in a specific category of business. You can improve that percentage by selecting two or more appropriate categories for your listing.

3. Include key financials.

Most buyers want to know the asking price, followedg by cash flow. Including these important financial details makes it easier for serious buyers to find your listing in a search and contact you.

4. A great headline.

“Profitable coffee shop in busy shopping mall,” and other headings with key details are better than “popular cafe.”

5. A well-written description.

A good description has all the essential facts, such as the business’s strengths and potential, number of employees, the owner’s reason for selling, and opportunities for expansion. Beware of exaggerations. A hyped-up listing will alienate serious buyers.

6. An attractive photo.

Even if you cannot use a photo of the actual business for confidentiality reasons, you should still post a stock photo. A good site to find generic, free stock photos is Pexels. The GABB administrator can also help you find photos. Buyers are more likely to notice listings with photos.

7. Seller financing!

Experienced business brokers know that financing is one obstacle in selling a business. So it’s a huge advantage if the owner is willing to carry part of the financing. Seller-financed businesses are more likely to sell than those that are not.

8. Broker contact details.

Your listing should include details on how to reach you easily. Every prospective buyer should receive a response from their inquiry within the first 24 hours. A slow response might mean you miss a qualified buyer.

The GABB website’s new listing feature is still undergoing improvements, so please let us know if you have suggestions for using this feature. To date, this feature is included in your GABB broker membership at no additional charge. For help with this feature, please contact GABB Executive Director Diane Loupe at georgiabusinessbrokers@gmail.com or GABB President Dean Burnette at 912-247-3209 or dean@b3brokers.com.

Read More

How to Create a Business Plan

If you’re hoping to borrow money to buy or start a business, you’ll probably need a business plan.

A business plan, which projects 3-5 years ahead, is your road map for your business. It outlines how a company plans to reach yearly milestones, including revenue projections. A well-thought-out plan also helps a business focus on its key elements and helps the owner make good decisions, according to the Small Business Administration.

Serial entrepreneur Alejandro Cremades, author of The Art of Startup Fundraising, says you “should have a plan in order to get yourself organized, to ensure you have some type of viable commercial potential, you have focus and hopefully aren’t going to run out of money or starve before you get going.”

The SBA’s Business Plan Tool is a free resource that guides you step-by-step to create the plan. Not only can you save your plan as a PDF file, you can also update it at any time, making this a living plan to which you can often refer. You can also use your completed business plan to discuss next steps with a mentor or counselor from an SBA resource partner such as SCORE, a Small Business Development Center (SBDC) or a Women’s Business Center (WBC).

All of your information entered into this tool can only be viewed by accessing your account using the password you have specified.

You can complete each section of SBA’s Business Plan Tool at your own pace, save your work at any time and pick up where you left off the next time you log into the tool. Your information will be saved for up to six months after your last login date.

Writing for Forbes, Cremades says that traditional business plans can be massive, expensive, time-consuming projects. If “you don’t plan to raise money, apply for loans and don’t intend on bringing in partners, then you certainly don’t need a 25lb manuscript. Keep it simple.” Brian Chesky, founder of Airbnb, is famous for his one-page business plan for global domination.

Harvard Business Review (HBR) says some business plans “end up nothing more than a fable.” That because HBR says “the real key to succeeding in business is being flexible and responsive to opportunities. Entrepreneurs often have to pivot their business once it becomes clear that their original customer is not the right customer, or when it turns out that their product or service fits better in an alternate market.”

HBR also wrote that:

- The “most successful entrepreneurs were those that wrote their business plan between 6-12 months after deciding to start a business. Stating that this “increased the probability of venture viability success by 8%.”

- Chances of success rose by 12% for those that spent no longer than three months on their plan. Spending more time than that was futile.

- Startups chances of venture viability rose by 27% if the plan was created at the same time that founders were talking to customers and preparing marketing.

According to Entrepreneur.com and Rule’s Book of Business Plans for Startups, founders should be considering these factors when creating their plan.

- How the business will be vested

- Main objectives

- Mission statement

- Keys to success

- Industry analysis

- Market analysis

- Competitor analysis

- Core strategies

- Marketing plans

- Management

- Organizational structure

- Key operations

- Projections and pro formas

- Break-even analysis

- Financial needs

SCORE, an SBA partner that provides free business mentoring and education, offers templates with instructions for each section of the business plan, followed by worksheets.

- Executive Summary

- Company Description

- Products and Services

- Marketing Plan

- Operational Plan

- Management & Organization

- Startup Expenses & Capitalization

- Financial Plan

- Appendices

For more help with getting business financing, consult one of the GABB’s professional SBA lenders who can advise you on what you need to get funding for your business.

Read More

What Kind of Business Seller Are You?

By Peter Siegel, MBA, Founder and President of BizBen.com.

Almost everyone who owns a company wants to put it up for sale sooner or later. And if the owner doesn’t have employees or family members ready to put up the money and take over the business, the owner must find a buyer in the business-for-sale market. Sadly, only one-third of the hopeful sellers in this market will be successful.

That means two-thirds of owners unable to connect with a buyer will ultimately have to close the business or give it away. The problem may be that the business simply is not desirable. But just as frequently, the reason an owner can’t make a sale is because he or she is one of the many seller types who inevitably will fail.

If the seller can identify what type of seller they are, they can gauge their chances of successfully selling their business.

1. Make a Killing Mike: Also known as “Make a Million, Mike,” this individual believes his business is worth more than any sensible buyer will pay for it. There are a number of ways Mike justifies the asking price. A popular idea is that a similar business recently sold for the price Mike wants. But no two businesses are alike, and Mike doesn’t understand that the “similar” business is much more profitable and in a better location. The market may not reward Mike if he should eventually lower the price to a figure close to its value. Buyers often are not interested in investigating a business that has been on the market for a long time – whatever the reason.

2. Clarence Can’t Carry: An important selling feature of most any business offering is the willingness of the seller to “carry back” part of the purchase price. Along with a cash down payment, the seller receives a promissory note usually secured by the business assets, to be paid off by the buyer over a period of time. It’s reassuring for a buyer when the seller is willing to help finance, because it demonstrates that the seller believes in the business and in the buyer’s ability to operate it successfully. An offering that can only be purchased with all cash is almost always unappealing compared to other opportunities that come with seller financing.

3. Rita Rosy Picture: According to Rita, her business is about to become as much in demand as this week’s most popular show business celebrity. She has the best inventory in town, the most helpful and loyal employees, and greater prospects for the future than any buyer can imagine. Even a business that does excel in some respects has its problems and disadvantages. Buyers know that and often don’t feel secure about an opportunity that is described only in the most optimistic way. When meeting with a seller who doesn’t come across as honest and credible, many buyers get a negative feeling about the opportunity – the opposite of what the seller intended.

4. Nick Not Ready: Any prospective buyers meeting Nick will wonder how he could be trying to sell his business but not be able to produce current financial information, a list of assets to be included, or a definitive description about the premises lease that the landlord will provide to a new owner. Does the seller have something to hide? Is he really that disorganized? If so, what does that say about the condition of the business? Did he neglect to “get his stuff together” because he doesn’t really believe the business is salable? These are questions that occur to buyers as they decide they aren’t interested in what Nick has to offer.

5. Don’t Worry Dorothy: When Dorothy tells a prospective buyer that he or she shouldn’t worry, the buyer usually worries. Buyers want to know what happens if the customer who accounts for half the company’s income decides to do business elsewhere. They want to understand the consequences if a large competitor moves into the neighborhood. If the seller can’t answer these questions, the buyers really won’t worry about those issues. That’s because they’ll look for another business to buy.

6. Secret Sam: One of the things Sam likes to tell prospective buyers is how much of the company’s income goes directly into his pocket without being recorded on the books. He may be proud of his skimming habit. He may think he’s quite clever at fooling the taxing authorities. He might think the buyer will add the total of unreported cash to the reported income and decide the business is making enough money to justify the asking price. But he’s mistaken. The buyers who investigate Sam’s business soon realize he can’t be trusted and move on to find out about other opportunities.

7. Realistic Ralph: Since he is motivated to sell, Ralph wants to present his business in a way that will generate positive responses from buyers. He understands he needs to be proactive in preparing the business for sale. The asking price accurately reflects market conditions. His books are in order and ready to be investigated by qualified buyers. Ralph met with financial institutions with the help of a niche financial advisor who specializes in business purchase financing. The business has been prequalified for financing. And Ralph is willing to carry back 20% of the price with a note. And he’s hired a professional business broker from the Georgia Association of Business Brokers who can develop a confidential plan to market his business to qualified buyers. His approach is a clear recipe for selling success.

If you identify with any of the first six seller types, you’re limiting your chances of selling your business. But if you assume the characteristics of Realistic Ralph, your business is likely to be among the one-third of business offerings that result in a sale.

About The Author: Peter Siegel, MBA is the Founder and President of BizBen.com. He is a SBA SCORE Counselor, author, consultant/coach (ProBuy, ProSell Programs), and advocate on the topic of buying and selling small to mid-sized businesses in the California marketplace. Having writen three books and hundreds of publication articles he has assisted small business owners/sellers, business brokers, agents, and business buyers for over 25 years. This article was adapted from one that originally appeared on his blog.

Read More