Headwinds Buffet Georgia’s Catalyst Sectors, Dampening Job Growth Outlook

ATLANTA–One-off factors, combined with an ongoing global slowdown, the U.S.-Chinese trade spat and a deteriorating domestic investment climate have resulted in unusually large deviations from average monthly job gain expectations in Georgia, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

“Monthly job creation numbers always fluctuate, just like monthly rainfall totals, and rarely is there a month that hits the so-called average mark. However, it’s rare to see three negative growth months out of nine, without a special reason,” Dhawan wrote in his quarterly “Forecast of Georgia and Atlanta,” released today (Nov. 20, 2019).

How big were the fluctuations? Georgia gained 23,200 jobs in the first quarter of 2019, followed by only 300 job gains in the second quarter, then roared back with 29,100 jobs in the third quarter of the year.

“Three marquee sporting events between December 2018 and February 2019 – the MLS Championship (Dec. 8), the Chick-Fil-A Bowl (Dec. 19) and Super Bowl LIII (Feb. 3) – delivered a positive hospitality boost to Atlanta,” Dhawan said.

From October 2018 to January 2019, Georgia added 39,100 jobs – a 33 percent boost to the 2018’s monthly jobs creation pace of 7,400 – with 20,800 of those gains in retail trade, hospitality and administrative services (proxy for temporary jobs). These service sectors account for 30 percent of the state’s employment base, but they produced 53 percent of job additions during those four months.

When the events were over, the three sectors shed 6,200 of the 9,700 jobs lost in March and April, explaining the ups and downs of job growth over the first two quarters.

The forecaster examined premium job creation in the state’s catalyst sectors – corporate, technology and manufacturing. The three sectors account for roughly one quarter of Georgia’s employment base, pay well above the median wage, and lead to demand for products and services, resulting in jobs in supporting sectors. One support sector, transportation, warehousing and utilities, has added only 700 jobs in the first three quarters of 2019 despite the growth of e-commerce.

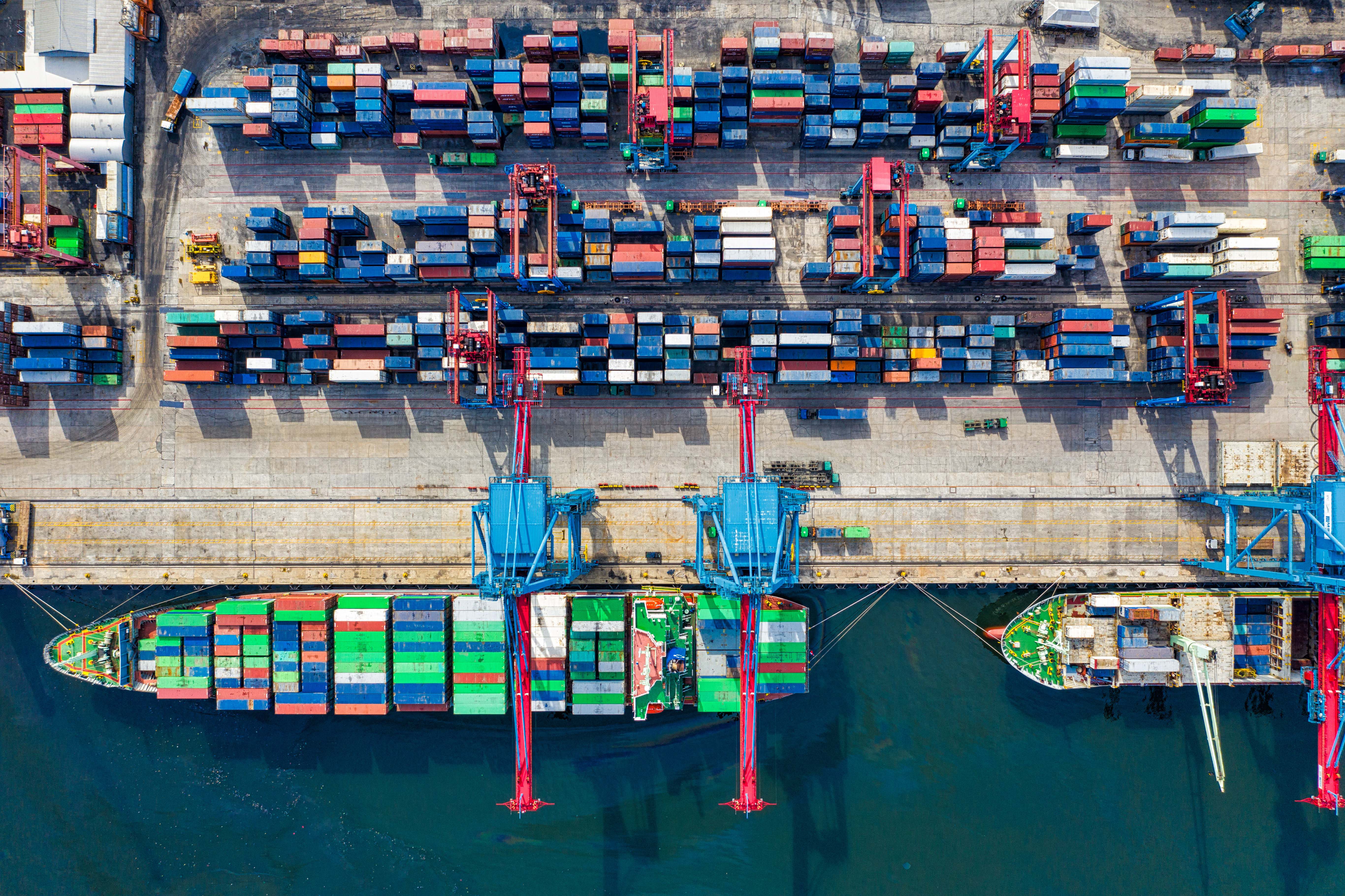

“But what about future prospects for transportation? E-commerce is not the entire story,” Dhawan said. “The health of the sector is also tied to activities at the port of Savannah and its network of warehouses. A slowing growth rate of tonnage generated at the port and a record high proportion of empty containers on outbound ships means fewer trips from warehouses to the port, less demand for storage and fewer jobs.”

Savannah exports are mostly manufactured products – cars from the Kia plant in LaGrange, paper and pulp products from Albany-area mills, automotive machinery from Athens and Gainesville, and industrial carpeting from Dalton.

“If the global slowdown, coupled with a strong dollar, reduces demand for Georgia exports, we will produce less, which will show up in the performance of the state’s manufacturing sector and employment growth in the Savannah metro area,” said Dhawan. “The global growth climate is so bad that Savannah-based Gulfstream announced it will lay off 362 people at its main facility in coming weeks. Loss of these high paying jobs is never good for the metro area where they happen.”

With the current economic expansion in its 10th year, the business cycle is maturing, and job quality is deteriorating, according to the forecaster. For example, in 2014 Georgia added 128,100 jobs of which 40 percent were in high-paying catalyst sectors. In 2018, when Georgia added 89,000 jobs the proportion of catalyst jobs had plunged to 12 percent.

According to Dhawan, the chance of an upsurge in total job creation is low for the coming six to eight quarters.

“Chalk it up to the ongoing global slowdown in Europe and Latin America, coupled with our trade spat with China and a weakening domestic investment climate. Global and domestic headwinds are buffeting Georgia’s catalyst sectors, making for an overall lower future growth path.”

Highlights from the Economic Forecasting Center’s Report for Georgia and Atlanta

- Georgia employment will add 72,200 jobs (13,200 premium jobs) in 2019, gain 49,700 jobs (8,900 premium) in 2020 and increase by 45,900 (8,900 premium) in 2021.

- Nominal personal income will grow 5.0 percent in 2019, 4.9 percent in 2020 and 4.7 percent in 2021.

- Atlanta will add 51,200 jobs (10,000 premium positions) in 2019, moderate to 38,100 jobs (7,800 premium) in 2020 and 34,300 jobs (7,300 premium) in 2021.

- Atlanta housing permitting activity will fall 16.4 percent in 2019, decline 6.9 percent in 2020 and fall another 5.5 percent in 2021.

Georgia State Forecaster Says Global Uncertainty Is Inducing Investment Malaise

ATLANTA–A maturing business cycle, the ongoing global slowdown, and the U.S.-China trade spat are fostering a deteriorating business investment climate, and a slowdown in job growth has made consumers wary of spending, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

“Investments are always a risky bet. And as the amount of uncertainty rises, investment spending is the first to suffer,” Dhawan wrote in his “Forecast of the Nation,” released today (Nov. 20, 2019).

The Global Economic Policy Uncertainty Index, at its highest level since 1997, has been extremely elevated for the past 18 months. Dhawan attributes the uncertainty in no small part to the imposition of tariffs by the world’s two largest trading partners, the U.S. and China, on each other’s exports.

“Although there are other trade skirmishes [between Japan and Korea, the ongoing Brexit saga, the Catalonia secession in Spain, and even the September missile attack on Saudi oil facilities] the U.S.-China trade spat takes center stage.”

The forecaster posits that as management of U.S.-based global companies consider moving factories out of China and undoing supply chains they spent decades establishing, “their primary focus is on the vexing issue of building new supply chains and not on expanding existing business capacity, i.e. hiring.”

The fallout is readily apparent in investment growth rates. Business investment declined 3.0 percent in the third quarter of 2019, after dropping 1.0 in the previous quarter, which was a dramatic contrast to the first half of 2018, when investment grew 8.4 percent following the Tax Cuts and Jobs Act of 2017. Two other factors, or shocks, contributed to weak investment – reduced fracking investment due to falling oil prices, and the impact of the March 2019 grounding of the Boeing 737 MAX on high tech manufacturing. Looking forward, the Institute for Supply Management Manufacturing Index is below 50, signaling future contraction in the industrial sector.

As for consumer confidence, a 10-point market drop since Aug. 2019 could signal a consumption growth slowdown. The last three Federal Reserve rate cuts should have boosted consumption by lowering interest rates for car loans and on new or refinanced mortgages. However, Oct. 2019 vehicle sales of 16.5 million units were much lower than the average 17.0 million units sold the previous three months.

Damage from the last few quarters of deficient investment growth will be evident in subpar GDP growth, less than 1.5 percent on average in the coming quarters. And Dhawan characterizes business investment equipment growth as “nonexistent” until Boeing’s woes end in mid-2020.

“As growth drops well below the 1.8 percent growth potential, the Fed will be forced to cut rates several times in early 2020, most likely during the March and June meetings of the Federal Open Market Committee,” Dhawan said.

Even with these cuts, Dhawan anticipates GDP growth to drop to 2.3 percent in 2019, then decline to 1.5 percent in 2020 and improve to 1.8 percent in 2021.

“The election will be over by 2021, hopefully, and no matter who is in the White House, businesses can plan again with somewhat more certainty than at present,” Dhawan said.

Highlights from the Economic Forecasting Center’s National Report

- Overall GDP growth will be 2.3 percent in 2019, 1.5 percent in 2020 and 1.8 percent in 2021.

- Investment growth will be 2.2 percent in 2019, 0.3 percent in 2020 and 2.5 percent in 2021. Monthly job gains will be 165,300 in 2019, drop to 90,600 in 2020 and rise to 94,700 in 2021.

- Housing starts will average 1.256 million in 2019, 1.215 million in 2020 and 1.220 million in 2021. Vehicle sales will average 16.9 million in 2019, 15.8 million in 2020 and 15.5 million in 2021.

- The 10-year bond rate will average 2.1 percent in 2019 and 2020, then rise to 2.7 percent in 2021.

Global Economic Woes Contribute to Continued Economic Moderation in Georgia

ATLANTA–Stuttering global growth and escalating trade tiffs that are affecting national economic prospects are also being felt in Georgia across many employment sectors, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

ATLANTA–Stuttering global growth and escalating trade tiffs that are affecting national economic prospects are also being felt in Georgia across many employment sectors, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

In his quarterly “Forecast of Georgia and Atlanta,” Dhawan wrote that he expects two Federal Reserve rate cuts before 2019 ends, asking, “Will these extra cuts help us negate the fallout from our trade spats? And what relief will it provide at the state and Atlanta metro levels?”

The forecaster’s answer to these questions is mixed. Yes, lower rates should help with interest-sensitive sectors such as home refinancing, vehicle sales and small business loans.

“But, these rate cuts cannot overcome the hesitation of big corporations to undertake the capital expansions that determine future job growth,” said Dhawan in the report released Aug. 28, 2019. “These firms are global in scope and dependent on external markets for a big proportion of their revenues.”

A case in point is Delta Air Lines. The state’s largest corporate employer collects 30 percent of its passenger revenue from international operations. In the second quarter of 2019, its global sector grew by 5.2 percent, compared to 8.7 percent for the same period in 2018.

The Port of Savannah, another transportation crown jewel, is largely responsible for driving the economic growth of the Savannah metro area. In mid-2018, Savannah’s job growth was 2.7 percent, outpacing the state’s job growth rate of 1.9 percent when global trade volumes were good. But by June 2019, Savannah’s growth rate dropped to 1.2 percent, putting it below the state’s 1.7 percent growth as the global economy cooled.

“Globally connected sectors and areas grow higher than average when the world economy is booming, but they decelerate sharply when the tide turns,” Dhawan said.

The global health of Fortune 500 companies headquartered in Georgia determines the hiring of managerial jobs in Atlanta, which has a multiplier effect on downstream sectors.

Domestic demand sectors are performing better than globally connected ones, particularly hospitality (historically high occupancy rates), education (growing due to population growth), healthcare (overall population growth and aging) and construction (new hotel, office and apartment developments).

“Fed rate cuts will alleviate the pain somewhat, and relatively clear skies will emerge, but without a rainbow,” said Dhawan.

Highlights from the Economic Forecasting Center’s Report for Georgia and Atlanta

- Georgia employment will add 65,200 jobs (11,400 premium jobs) in 2019, gain 53,500 jobs (9,400 premium) in 2020 and increase by 48,200 (9,700 premium) in 2021.

- Nominal personal income will grow 4.3 percent in 2019, then increase by a better 5.1 percent in 2020 and 2021.

- Atlanta will add 45,300 jobs (7,900 premium positions) in 2019, moderate to 37,900 jobs (7,200 premium) in 2020 and 35,600 jobs (7,300 premium) in 2021.

- Atlanta housing permitting activity will fall 18.9