Headwinds Buffet Georgia’s Catalyst Sectors, Dampening Job Growth Outlook

ATLANTA–One-off factors, combined with an ongoing global slowdown, the U.S.-Chinese trade spat and a deteriorating domestic investment climate have resulted in unusually large deviations from average monthly job gain expectations in Georgia, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

“Monthly job creation numbers always fluctuate, just like monthly rainfall totals, and rarely is there a month that hits the so-called average mark. However, it’s rare to see three negative growth months out of nine, without a special reason,” Dhawan wrote in his quarterly “Forecast of Georgia and Atlanta,” released today (Nov. 20, 2019).

How big were the fluctuations? Georgia gained 23,200 jobs in the first quarter of 2019, followed by only 300 job gains in the second quarter, then roared back with 29,100 jobs in the third quarter of the year.

“Three marquee sporting events between December 2018 and February 2019 – the MLS Championship (Dec. 8), the Chick-Fil-A Bowl (Dec. 19) and Super Bowl LIII (Feb. 3) – delivered a positive hospitality boost to Atlanta,” Dhawan said.

From October 2018 to January 2019, Georgia added 39,100 jobs – a 33 percent boost to the 2018’s monthly jobs creation pace of 7,400 – with 20,800 of those gains in retail trade, hospitality and administrative services (proxy for temporary jobs). These service sectors account for 30 percent of the state’s employment base, but they produced 53 percent of job additions during those four months.

When the events were over, the three sectors shed 6,200 of the 9,700 jobs lost in March and April, explaining the ups and downs of job growth over the first two quarters.

The forecaster examined premium job creation in the state’s catalyst sectors – corporate, technology and manufacturing. The three sectors account for roughly one quarter of Georgia’s employment base, pay well above the median wage, and lead to demand for products and services, resulting in jobs in supporting sectors. One support sector, transportation, warehousing and utilities, has added only 700 jobs in the first three quarters of 2019 despite the growth of e-commerce.

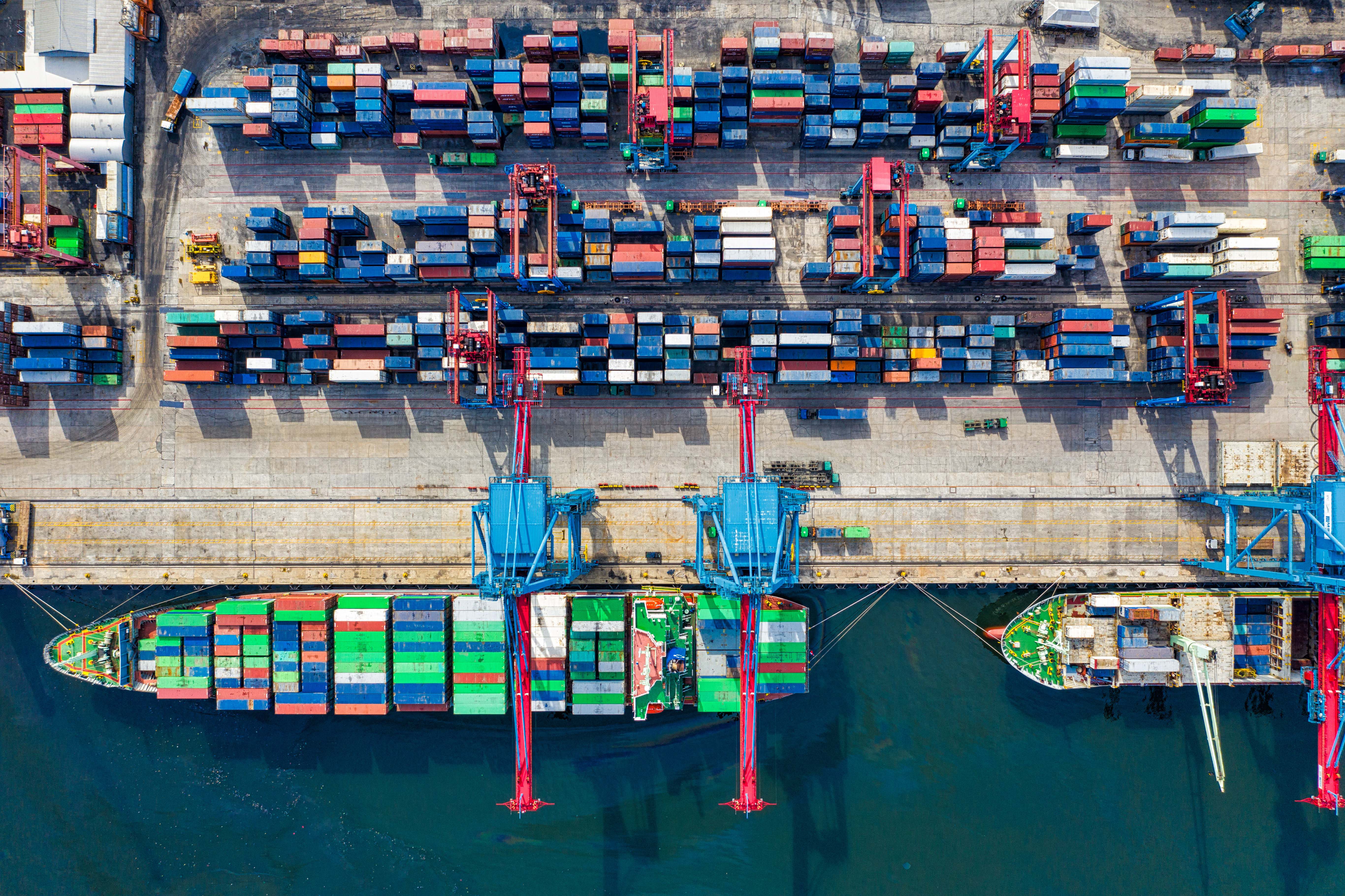

“But what about future prospects for transportation? E-commerce is not the entire story,” Dhawan said. “The health of the sector is also tied to activities at the port of Savannah and its network of warehouses. A slowing growth rate of tonnage generated at the port and a record high proportion of empty containers on outbound ships means fewer trips from warehouses to the port, less demand for storage and fewer jobs.”

Savannah exports are mostly manufactured products – cars from the Kia plant in LaGrange, paper and pulp products from Albany-area mills, automotive machinery from Athens and Gainesville, and industrial carpeting from Dalton.

“If the global slowdown, coupled with a strong dollar, reduces demand for Georgia exports, we will produce less, which will show up in the performance of the state’s manufacturing sector and employment growth in the Savannah metro area,” said Dhawan. “The global growth climate is so bad that Savannah-based Gulfstream announced it will lay off 362 people at its main facility in coming weeks. Loss of these high paying jobs is never good for the metro area where they happen.”

With the current economic expansion in its 10th year, the business cycle is maturing, and job quality is deteriorating, according to the forecaster. For example, in 2014 Georgia added 128,100 jobs of which 40 percent were in high-paying catalyst sectors. In 2018, when Georgia added 89,000 jobs the proportion of catalyst jobs had plunged to 12 percent.

According to Dhawan, the chance of an upsurge in total job creation is low for the coming six to eight quarters.

“Chalk it up to the ongoing global slowdown in Europe and Latin America, coupled with our trade spat with China and a weakening domestic investment climate. Global and domestic headwinds are buffeting Georgia’s catalyst sectors, making for an overall lower future growth path.”

Highlights from the Economic Forecasting Center’s Report for Georgia and Atlanta

- Georgia employment will add 72,200 jobs (13,200 premium jobs) in 2019, gain 49,700 jobs (8,900 premium) in 2020 and increase by 45,900 (8,900 premium) in 2021.

- Nominal personal income will grow 5.0 percent in 2019, 4.9 percent in 2020 and 4.7 percent in 2021.

- Atlanta will add 51,200 jobs (10,000 premium positions) in 2019, moderate to 38,100 jobs (7,800 premium) in 2020 and 34,300 jobs (7,300 premium) in 2021.

- Atlanta housing permitting activity will fall 16.4 percent in 2019, decline 6.9 percent in 2020 and fall another 5.5 percent in 2021.