Pandemic Will Impact Business Valuations

The COVID-19 pandemic is going to affect the valuation of businesses, and professionals are likely to take into account a wider number of factors when determining the fair market value of a business.

That’s what two business valuation experts told the Georgia Association of Business Brokers in a conference call on Tuesday, May 26. Dan Browning is the founder and President of DB Consulting, Inc. and David H. Hern, CPA/ABV, ASA, CEPA, a financial analyst with Sofer Advisors spoke to the GABB online. View the conference online here.

“The biggest issue is uncertainty, which heightens the risk, and higher risk leads to lower value,” Browning said. People who assign values to businesses are, by their nature, trying to predict future business conditions, which is tricky anytime, but particularly now. While many businesses have suffered, some businesses “have gone gangbusters,” Browning said. The cost of capital has actually gone down for some businesses, specifically those that have been able to obtain SBA-backed assistance in the form of grants or low-interest loans.

However, some valuation clients are “taking advantage of uncertainty,” Hern said. Some clients are using this time to “do tricky estate planning, issue equity grants, possibly get values frozen below normal,” he said.

If a business valuation was triggered before the onset of the pandemic in the US, some will argue it’s a subsequent event, and should not affect the pre-crisis value. Browning said he has started including an appendix, a disclaimer, calling COVID-19 a subsequent event, which didn’t affect value as of the valuation date.

Browning shared a timeline from respected business valuation expert Jim Hitchner who tracks the impact of the virus on various markets.

Hern shared a Sofer analysis of the mobility of the U.S. Market Mobility of US Market Sofer document

Restaurants have been seriously impacted by the crisis, and many are trying to decide whether it’s worth reopening. Some, like pizza restaurants, have adapted better to a takeout model.

Restaurant broker Dominique Maddox said many of his clients are opting not to reopen and are trying to sell their assets and get out from a multi-year lease. Pizza concepts were able to keep going strong, Maddox said.

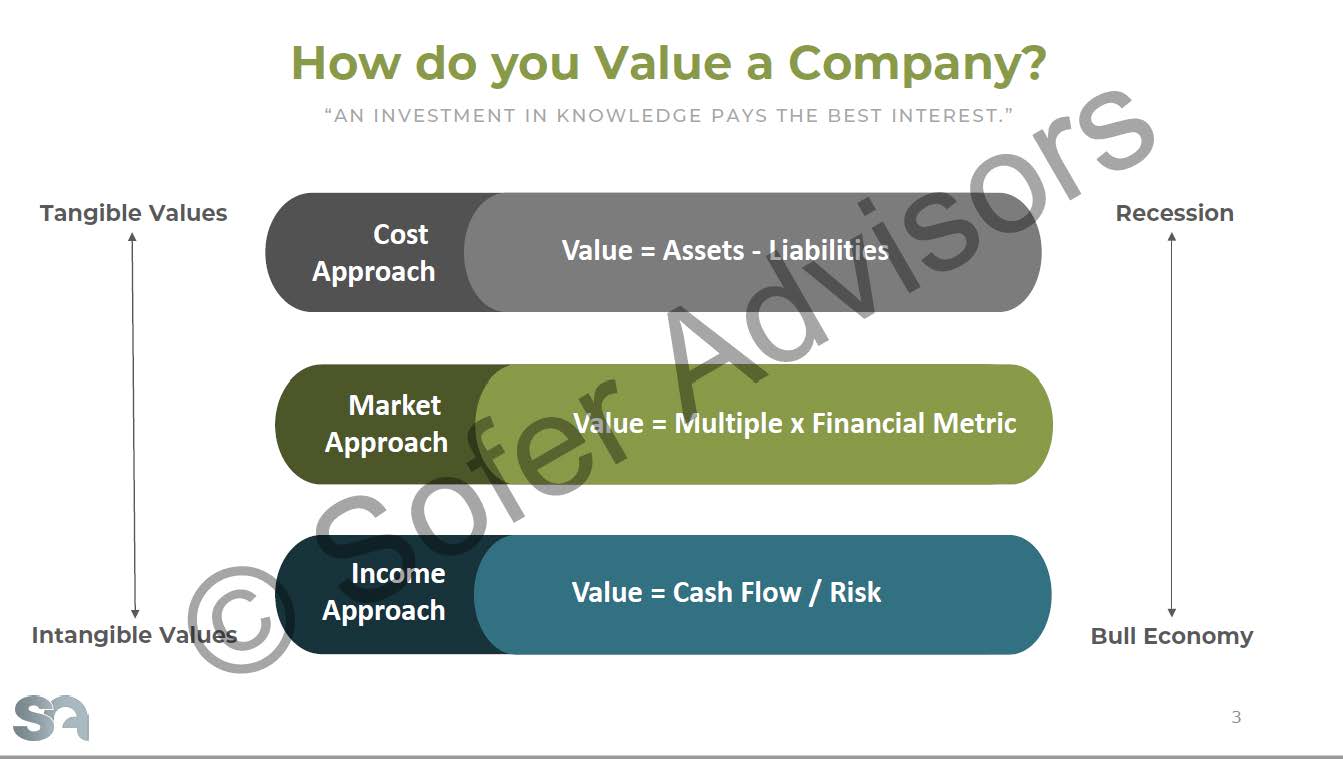

Hern cited three approaches to business valuation: Cost Approach, in which the value of the business is equal to their assets minus liabilities. The Market Approach determines the value of a business based on a multiple and a financial metric. The Income Approach sets the value at cash flow divided by risk.

Hern cited three approaches to business valuation: Cost Approach, in which the value of the business is equal to their assets minus liabilities. The Market Approach determines the value of a business based on a multiple and a financial metric. The Income Approach sets the value at cash flow divided by risk.

The methods skew towards tangible values during a recession, and during bull economy tends to more intangible values. Hern says he’s been running a variety of scenarios taking into account whether the economic recovery may be V-shaped, U-shaped or something else. Browning predicted a W-shaped recovery, with ups and downs.

Businesses may be getting valuations that specify a range of values instead of a single value, Browning said.

“It’s important not to get too negative,” Browning said. “There is a going to be a recovery, there is going to be coming out of all of this.” The recovery may be bumpy, but it will come.

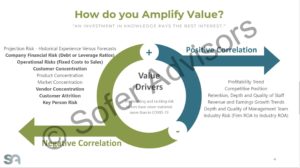

Hern is recommending that business owners prepare their businesses to be in the best shape for the future, fixing problems. You can amplify value by reducing the customer concentration, reducing debt, improving their competitive position, improving staff depth and retention, etc.

“Companies that have fixed these types of issues will sell for better value,” Hern said.

Hern said he will be looking at vendor concentration in the future when valuing a business.

“Doing business is going to be more expensive going forward,” said Browning. Businesses are going to have to buy extra cleaning supplies, extra protective gear, more training of employees.

Hern’s presentation: GABB Sofer

Dan Browning is the founder and President of DB Consulting, Inc. His credentials include:

Dan Browning is the founder and President of DB Consulting, Inc. His credentials include:

- Master Analyst in Financial Forensics (MAFF) from the National Association of Certified Valuators and Analysts, originally awarded August 1999

- Accredited in Business Appraisal Review (ABAR) from the National Association of Certified Valuators and Analysts, originally awarded March 2010

- Georgia Association of Business Brokers (Affiliate Member)

- State Bar of Georgia (Active Member; Eminent Domain and Nonprofit Law Section Memberships)

- Editorial Board, Business Appraisal Practice (IBA Journal) 2013-2015

- University of Notre Dame, Master of Arts (Government), January 1995

- Emory University School of Law, Juris Doctor, May 1992

- Emory University, Bachelor of Arts, May 1985; Phi Beta Kappa

David H. Hern, CPA/ABV, ASA, CEPA, is a highly qualified financial analyst with Sofer Advisors.He has exceptional credentials in determining the true, comprehensive value of an organization. In addition, he has something even more rare: a proven ability to simply and clearly communicate analysis to boards of directors, legal and financial advisors, Company management (CEOs, CFOs, controllers, etc.) and private equity portfolio managers. Mr. Hern offers litigation assistance, estate and tax planning, and business enterprise valuations for various privately-held and public companies. He has been recognized for enabling organizations to determine their enterprise and equity value for a variety of situations

David H. Hern, CPA/ABV, ASA, CEPA, is a highly qualified financial analyst with Sofer Advisors.He has exceptional credentials in determining the true, comprehensive value of an organization. In addition, he has something even more rare: a proven ability to simply and clearly communicate analysis to boards of directors, legal and financial advisors, Company management (CEOs, CFOs, controllers, etc.) and private equity portfolio managers. Mr. Hern offers litigation assistance, estate and tax planning, and business enterprise valuations for various privately-held and public companies. He has been recognized for enabling organizations to determine their enterprise and equity value for a variety of situations

Education

- Georgia Institute of Technology, Scheller College of Business, Atlanta GA. Masters of Business Administration, Finance emphasis.

- Georgia Institute of Technology, Scheller College of Business, Atlanta, GA. Bachelors of Science, Management with Accounting emphasis.

Certifications

- Certified Public Accountant (CPA) — State of Georgia

- Accredited in Business Valuation (ABV)

- Accredited Senior Appraiser (ASA)

- Certified Exit Planning Advisor (CEPA)