Buying and Selling Businesses in a Pandemic: GABB Feb. 23

Despite the challenges posed by the pandemic in 2020, many Georgia business brokers continued to sell more than a million dollars worth of businesses. GABB board member Tanya Nebo and six members of the GABB Million Dollar Club offered a wide variety of advice on Tuesday, Feb. 23, during a panel discussion of how to buy and sell businesses during a pandemic.

To view their comments on how they prospered in 2020, watch this video posted on GABB’s new YouTube channel.

Among the 2020 members of the GABB’s Million Dollar Club who will be on hand on Feb. 23 are Jefffery Merry, senior business analyst at the BUSINESS HOUSE, inc.; J. Snypp, Vice President of Preferred Business Brokers, Inc.; Matt Wochele, founder of Preferred Business Brokers, Inc.; Rob Margeton, an M&A Intermediary with Ryco Advisors, LLC; Brian Judson, a business broker with Best Business Brokers; and Jon Roman, business intermediary, franchise consultant and developer at Transworld Business Advisors.

Ms. Nebo is both a business broker and an attorney. Her law practice, real estate agent and business brokerage services focus on commercial real estate, franchising and general business matters (including joint ventures and equity participation models). She is a graduate of Columbia University in New York and the University of Virginia School of Law.

The GABB is the state’s premier association of professionals who help in the purchase and sale of businesses. GABB is committed to promoting professionalism, education and high ethical standards in the profession of business brokering.

For more information, contact GABB President Judy Mims at 404-842-1997 or judy@childcare.properties, or Ms. Loupe at diane.loupe@gabb.org or 770-744-3639.

Read More

SBA Improves First Draw Paycheck Protection Program Loan Review

WASHINGTON – The U.S. Small Business Administration is taking steps to improve the First Draw Paycheck Protection Program loan review so that small businesses have as much time as possible to access much needed PPP funds. The Biden-Harris Administration is focused on ensuring small businesses receive the support they need to keep their doors open and continue to employ millions of Americans across the country. The Administration is working with the Agency to identify immediate solutions to address eligibility, compliance, integrity, and promote transparency.

While reviewing the initial draw of PPP loans, anomalies – mostly data mismatches and eligibility concerns – were identified in approximately 4.7% of the lender-submitted data. These concerns will require follow-up between the lender and the borrower so that borrowers can access a second round of loans.

The SBA is committed to working with lenders and eligible borrowers to provide the necessary information for follow-up and help get small businesses back on track so that they’re able to receive another round of PPP loans swiftly. The SBA encourages borrowers and lenders to work together as quickly as possible to resolve the issues. The SBA will automatically move favorable decisions to approval. During the newest round of PPP, the SBA has already approved over 400,000 loans for approximately $35 billion.

“Prior to this newest PPP round, the SBA supported 5.2 million PPP loan borrowers, providing more than $525 billion in economic relief to small businesses and other eligible entities,” said SBA Acting Administrator Tami Perriello. “The Agency is committed to making sure compliance checks are executed on the front-end. The SBA is also committed to addressing issues more efficiently moving forward, to ensure fair and equitable access to small businesses in every community.”

The SBA is immediately addressing the PPP loan review to allow for Second Draw PPP loan applications to be processed in an efficient manner by:

- Hosting a national call to brief lenders on the Platform’s additional detailed information that will assist in the resolution of First Draw PPP loan review and potential holds that impact Second Draw PPP loan application approvals.

- Equipping the Agency’s field team of lender relations specialists with information so they can provide support to lenders and borrowers in understanding the issues and facilitating the appropriate responses to resolve

- Providing additional guidance to PPP lenders on the review and resolution process.

Many Affiliate members of the Georgia Association of Business Brokers are working with the SBA and the PPP program. Find a GABB SBA loan expert here.

Through SBA’s 68 district offices, the Agency will work in close partnership with the Administration to further leverage its resource partner network and expand on multilingual access and outreach about the PPP. Updated PPP information, including forms, guidance, and resources is at www.sba.gov/ppp and at the U.S. Treasury Department’s www.treasury.gov/cares.

How to Resolve First Draw PPP Loan “Unresolved Borrowers” and Hold Codes: PPP Procedures Webinar Slide Deck

Read More

SBA Bankers Discussed New Small Business Aid at Jan. 26 GABB Meeting

Bankers with expertise in handling SBA loans talked about applying for the next round of Paycheck Protection Program (PPP) funding at the Jan. 26 virtual meeting of the Georgia Association of Business Brokers.

A recording of the meeting is linked here.

GABB Affiliate Representative Kim Eells , Senior Vice President of SBA Business Development at Georgia Primary Bank, spoke along with Thomas Rockwood, Senior Vice President of SBA Lending at Atlantic Capital Bank and Cadence Bank Vice President and SBA Banker Ryan Stoll.

Here’s some PPP background from Kim Eells’ bank, Georgia Primary.

Thomas Rockwood’s bank, Atlantic Capital’s link, has this information.

Ryan Stoll’s bank, Cadence Bank, has posted this information.

SBA links to various Coronavirus Relief Options.

The Paycheck Protection Program (PPP) reopened the week of January 11 for new borrowers and certain existing PPP borrowers, according to the U.S. Small Business Association. This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan, the SBA says.

PPPSD Revenue Reduction Documentation_2021_01_19

The SBA says a borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

Has no more than 300 employees; and - Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

- The GABB is the state’s premier organization devoted to buying and selling businesses and franchises, and operates the state’s only real estate school dedicated to business brokering.

For more information about GABB, please email diane.loupe@gabb.org or call or text 770-744-3639, or contact GABB president Judy Mims at judy@childcare.properties or 404-842-1997.

Read MoreSBA and Treasury Announce PPP Re-Opening; Issue New Guidance

SBA and Treasury Announce PPP Re-Opening; Issue New Guidance

The U.S. Small Business Administration, in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers.

To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13.

The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act. The SBA also extended the deadline to apply for the Economic Injury Disaster Loan (EIDL) program for the COVID-19 Pandemic disaster declaration to December 31, 2021.

This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan.

SBA Administrator Jovita Carranza

“The historically successful Paycheck Protection Program served as an economic lifeline to millions of small businesses and their employees when they needed it most,” said SBA Administrator Jovita Carranza. “Today’s guidance builds on the success of the program and adapts to the changing needs of small business owners by providing targeted relief and a simpler forgiveness process to ensure their path to recovery.”

US Treasury Secretary Steven Mnuchin

“The Paycheck Protection Program has successfully provided 5.2 million loans worth $525 billion to America’s small businesses, supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin. “This updated guidance enhances the PPP’s targeted relief to small businesses most impacted by COVID-19. We are committed to implementing this round of PPP quickly to continue supporting American small businesses and their workers.”

Key PPP updates include:

- PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

- PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

- The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, destination marketing organizations, among other types of organizations;

- The PPP provides greater flexibility for seasonal employees;

- Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

- Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

- A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

- Has no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

- PPP Guidance from SBA Administrator Carranza on Accessing Capital for Minority, Underserved, Veteran, and Women-owned Business Concerns;

- Interim Final Rule on Paycheck Protection Program as Amended by Economic Aid Act; and

- Interim Final Rule on Second Draw PPP Loans

For more information on SBA’s assistance to small businesses, visit sba.gov/ppp or treasury.gov/cares.

SBA Georgia District Office

233 Peachtree Street NE, Suite #300

Atlanta, GA 30303

Phone: (404) 331-0100

www.sba.gov/ga

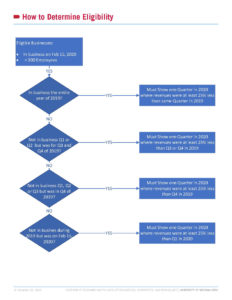

How To Determine Eligibility for Economic Aid

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. This information is provided by the UGA Small Business Development Center, which will continue to update their information as the approval process progresses and s and the SBA releases guidelines.

How to Determine Eligibility for Economic Aid: