SBA and Treasury Announce PPP Re-Opening; Issue New Guidance

SBA and Treasury Announce PPP Re-Opening; Issue New Guidance

The U.S. Small Business Administration, in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers.

To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13.

The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act. The SBA also extended the deadline to apply for the Economic Injury Disaster Loan (EIDL) program for the COVID-19 Pandemic disaster declaration to December 31, 2021.

This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan.

SBA Administrator Jovita Carranza

“The historically successful Paycheck Protection Program served as an economic lifeline to millions of small businesses and their employees when they needed it most,” said SBA Administrator Jovita Carranza. “Today’s guidance builds on the success of the program and adapts to the changing needs of small business owners by providing targeted relief and a simpler forgiveness process to ensure their path to recovery.”

US Treasury Secretary Steven Mnuchin

“The Paycheck Protection Program has successfully provided 5.2 million loans worth $525 billion to America’s small businesses, supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin. “This updated guidance enhances the PPP’s targeted relief to small businesses most impacted by COVID-19. We are committed to implementing this round of PPP quickly to continue supporting American small businesses and their workers.”

Key PPP updates include:

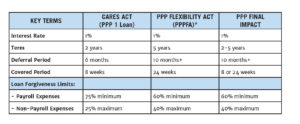

- PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

- PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

- The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, destination marketing organizations, among other types of organizations;

- The PPP provides greater flexibility for seasonal employees;

- Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

- Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

- A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

- Has no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

- PPP Guidance from SBA Administrator Carranza on Accessing Capital for Minority, Underserved, Veteran, and Women-owned Business Concerns;

- Interim Final Rule on Paycheck Protection Program as Amended by Economic Aid Act; and

- Interim Final Rule on Second Draw PPP Loans

For more information on SBA’s assistance to small businesses, visit sba.gov/ppp or treasury.gov/cares.

SBA Georgia District Office

233 Peachtree Street NE, Suite #300

Atlanta, GA 30303

Phone: (404) 331-0100

www.sba.gov/ga

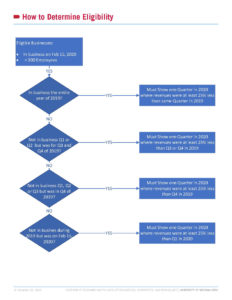

How To Determine Eligibility for Economic Aid

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. This information is provided by the UGA Small Business Development Center, which will continue to update their information as the approval process progresses and s and the SBA releases guidelines.

How to Determine Eligibility for Economic Aid:

Economic Aid to Hard-Hit Small Businesses: Overview

OVERVIEW: Provided by the UGA Small Business Development Center

ECONOMIC AID TO HARD-HIT SMALL BUSINESSES, NONPROFITS AND VENUES ACT

CURRENT STATUS: Signed into Law on 12/27/2020

The Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act is part of a the Consolidated Appropriations Act of 2021. This Act provides designed funding to support small business impacted by

COVID-19. While some components of the program are similar to the CARES Act passed in March 2020, there are some key differences. In addition, the U.S. Small Business Administration (SBA) has not released their official guidance. We will continue to update this document as the approval process progresses and the SBA releases guidelines.

Key Components of the Act

- Second Draw of Paycheck Protection Program Loan (PPP2)

- Targeted COVID-19 Economic Injury Disaster Loan (EIDL) Advance

- SBA Guaranteed Loan Debt Relief

- Targeted Programs for:

- Hardest Hit Businesses

- Disadvantaged Businesses

- Resolves tax treatment of PPP Forgiveness and Debt Relief Payment

Second Draw of Paycheck Protection Program (PPP2)

Eligible Businesses:

- Must have experienced at least one quarter in 2020 with revenues >25% below corresponding 2019 quarter

- No more than 300 employees

- Must have or will use full amount of initial PPP loan funds (PPP1)

- Same business types as qualified for initial PPP loans

- Had to be in business on February 15, 2020

Loan limit of $2M and $10 if combined with PPP1, based on:

- 5X average monthly 2019 payroll (same as PPP1)

- 5X if you’re a business with a NAICS Code beginning in 72

• Additional Eligible Expenses:

- Operations Expenditures – software, cloud computing, HR and accounting expenses

- Property Damage Costs – repair expenses due to public disturbances not covered by your insurance

- Supplier Costs – supplier costs essential to your business

- Worker Protection Expenditure – cost incurred to protect workers from COVID-19

- Employer Provided Group Insurance – can be included as payroll costs

• Can request an increase in PPP1 loan if SBA updated regulations would have allowed it (e.g. Owner’s Draw)

• Seasonal Employer

- Operates for no more than seven months in a year

- Earned no more than 1/3 of its receipts in any six month period during prior calendar year

- Can use highest 12 consecutive weeks of payroll between 2/15/2019 and 2/15/2020 to calculate loan size

• 501(c)(6) now eligible – cannot have more than 15% of its revenue from lobbying efforts

• Loans available through March 31, 2021

• For loans under $150k – forgiveness application is now a one-page certification that identifies:

- Number of employees you were able to retain

- Estimate of amount spent on payroll

- Total loan amount

• Must attest to the use of funds for allowable expenses only

• SBA will issue this form within 24 days of enactment

• Emergency EIDL grants extended through Dec. 31, 2021.

- Repeals the EIDL Advance Deduction from forgiveness (those already forgiven will be ‘made whole’)

• Targeted Advances to eligible entities:

- “Grosses-up” the difference between what was granted earlier and $10k

- Provides $10k grant to those who did not get grants because funding had run out

• To qualify for the full $10,000 EIDL grant, a business must:

- Be located in a low-income community, and

- Have suffered an economic loss greater than 30%, and

- Employ no more than 300

• In addition, the business must qualify as an eligible entity as defined in the CARES Act:

- A small business, cooperative, ESOP Tribal concern, with fewer than 300 employees

- An individual who operates under as a sole proprietorship, with or without employees, or as an independent contractor; or a private non-profit or small agricultural

- The business must have been in operation by January 31,

- The business must be directly affected by COVID-19.

- ECONOMIC LOSS —The term ‘‘economic loss’’ means, with respect to a covered entity—

- (A) the amount by which the gross receipts of the covered entity declined during an 8-week period between March 2, 2020, and December 31, 2021, relative to a comparable 8-week period immediately preceding March 2, 2020, or during 2019; or

- (B) if the covered entity is a seasonal business concern, such other amount determined appropriate by the Administrator.

SBA Guaranteed Loan Debt Relief

• Pays an additional 3 months of principal and interest (P&I) on existing 7(a), 504 and Microloans

- Begins in February 2021 – capped at $9,000 per month

- After 3 months – businesses with selected NAICS codes will receive an additional 5 months of P&I payments – capped at $9000 per month

- Designated NAICS Codes beginning in: 61, 71, 72, 213, 315, 448, 451, 481, 485, 511, 512, 515, 531, or 812

• Pays 6 months of P&I for any new SBA guaranteed loans approved before Sept. 30, 2021.

- Plus 3 months after first 6 months of payments

- Plus 5 months if you have a qualifying NAICS Code

• Improvements have been made to the SBA 7(a) program

- Increased SBA guarantee level to 90%

- Reduced or eliminated some fees

$15B for SBA grants to:

- Theatrical producers and talent representatives

- Operators of:

- Live venues

- Live performing arts organizations

- Museums

- Independent motion picture theatres

- Must demonstrate a 25% reduction in revenue

- Can be up to $10 million dollars with a potential supplement of 50%

- $2B is set-aside for those with less than 50 employees

Timing of Grants:

- In the initial 14 days, grants will be exclusively made to those with 90% or greater revenue loss

- In the second 14 days, grants will be to those with 70% or greater revenue loss

- After these two rounds – all other qualifying entities will receive awards

- NOTE – if you receive a grant, you cannot participate in PPP2

Focus on Disadvantaged Businesses

- $15B is set aside for Community Development Financial Institutions (CDFI) and Minority Depository Institutions (MDI)

- Programs Targeted at Specific Business Segments

- Child Care Providers

- Transportation Providers

- Rental Assistance

Resolution of Tax Issues

- Expenses paid by PPP funds can be claimed as business expenses

- Resolves the IRS and Treasury guidance that this would constitute ‘double-dipping’ and they couldn’t be used as business expenses

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Debt relief payment of P&I will not be treated as income

- Reverses recent guidance that required lenders to issue 1099 forms to borrowers benefiting from this program

- Makes the language retroactive ‘as if it were included in the original CARES Act”

- Pull together your financial information and be ready when bank portals

- The information needed is nearly identical to what you did for

For updated information:

- Watch for SBA and Treasury guidance – our website is a good source of information https://www.georgiasbdc.org

- We have additional webinar opportunities coming up and an on-demand https://www.georgiasbdc.org/2nd-round-covid-funding-webinars/

Next Steps

• Review your options as listed in this document.

- Contact your local UGA SBDC office to speak with a business consultant. There are 18 offices located throughout Georgia, serving every During this time, consultants are available via phone, email or video-conference only.

• Your business consultant will be able to answer any questions you may have. He/she will be available to assist you as you navigate the application process.

ABOUT THE UGA SBDC

The UGA Small Business Development Center (SBDC) provides tools, training and resources to help small businesses grow and succeed.

Designated as one of Georgia’s top providers of small business assistance, the UGA SBDC has 18 offices to serve the needs of Georgia’s business community.

ALBANY 229-420-1144

ATHENS 706-542-7436

GEORGIA STATE UNIVERSITY 404-413-7830

AUGUSTA 706-650-5655

BRUNSWICK 912-264-7343

UNIVERSITY OF WEST GEORGIA 678-839-5082

COLUMBUS 706-569-2651

DEKALB 770-414-3110

GAINESVILLE 770-531-5681

GWINNETT 678-985-6820

KENNESAW STATE UNIVERSITY 470-578-6450

MACON 478-757-3609

MOREHOUSE COLLEGE 470-268-5793

CLAYTON STATE UNIVERSITY 678-466-5100

ROME 706-622-2006

SAVANNAH 912-651-3200

GEORGIA SOUTHERN UNIVERSITY

912-478-7232

VALDOSTA STATE UNIVERSITY 229-245-3738

The University of Georgia SBDC is a Public Service and Outreach unit of the University of Georgia, funded in part through a cooperative agreement with the U.S. Small Business Administration.

Read More

SBA Extends COVID-19 EIDL Application Deadline through 2021

WASHINGTON— The U.S. Small Business Administration (SBA) announced that the deadline to apply for the Economic Injury Disaster Loan (EIDL) program for the COVID-19 Pandemic disaster declaration is extended to December 31, 2021. The deadline extension comes as a result of the recent bipartisan COVID-19 relief bill passed by Congress and enacted by the President on December 27, 2020.

WASHINGTON— The U.S. Small Business Administration (SBA) announced that the deadline to apply for the Economic Injury Disaster Loan (EIDL) program for the COVID-19 Pandemic disaster declaration is extended to December 31, 2021. The deadline extension comes as a result of the recent bipartisan COVID-19 relief bill passed by Congress and enacted by the President on December 27, 2020.

To date, SBA has approved $197 billion in low-interest loans which provide U.S. small businesses, non-profits and agricultural businesses working capital funds to help America’s small businesses make it through this challenging time.

“Following the President’s declaration of the COVID-19 Pandemic, SBA has approved over 3.6 million loans through our Economic Injury Disaster Loan program nationwide,” Administrator Jovita Carranza said. “The EIDL program has assisted millions of small businesses, including non-profit organizations, sole proprietors and independent contractors, from a wide array of industries and business sectors, to survive this very difficult economic environment.”

EIDL loan applications will continue to be accepted through December 2021, pending the availability of funds. Loans are offered at very affordable terms, including a 3.75% interest rate for small businesses and 2.75% for non-profit organizations, a 30-year maturity, and an automatic deferment of one year before monthly payments begin. Every eligible small business and non-profit are encouraged to apply to get the resources they need.

About the U.S. Small Business Administration

The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.

Read More

SBA Credit Underwriting Questions During the Pandemic

GABB Affiliate Board Representative Kim Eells, Senior Vice President of SBA Business Development at Georgia Primary Bank, says the SBA requires answers to these ten questions on every loan. These are critical when a business owner wants to sell their business.

SBA Guidance on additional Credit Underwriting Questions for loan customers during the pandemic:

SBA Guidance on additional Credit Underwriting Questions for loan customers during the pandemic:

- Does the Applicant and/or Seller of a business have a PPP or EIDL loan? If so, what is the loan’s status?

- How has the business and its industry been impacted by the Covid-19 emergency? Have business revenue and staffing levels been impacted? What is the plan to return to normal operations? does the business have a contingency plan for revenues and operations for a minimum of the next 18 months?

- How have any restrictions such as “stay-at-home orders,” social distancing, travel, traffic flow, and trade limitations impacted the applicant’s cost projections, clientele or access to supplies, inventory and/or equipment?

- What are the other impacts to the business’ operational cost(s) such as providing protective gear, cleaning materials and essential costs to ensure the safety of customers and employees?

- Is the historical financial information reliable based on current market conditions? Consider using month to month financial proforma with break-even analysis based on current market conditions (i.e. unemployment rates, decreased household disposable income).

- How concentrated or diversified is the customer base? How reliant is the applicant on sales to or receivables from customers in those concentrations?

- How concentrated or diversified is the applicant’s vendor/supplier pool, and which, if any, vendors or suppliers have decreased ability to support the business?

- What impact have current market conditions had on collateral adequacy, i.e value of property, equipment, etc.?

- For Change of Ownership loans, given current market conditions, does the applicant have adequate industry experience to operate the business?

- For any loans where 50% or more of the loan proceeds will be used for working capital, the Lender should specifically address in its credit memorandum why this level of working capital is necessary and appropriate for the subject business in light of the COVID-19 emergency.

Note: All 7(a) Lenders should review the business valuation to ensure that it addresses the economic impact of the COVID-19 emergency, including such factors as whether the business provides essential or nonessential services, has been subject to closures or occupancy restrictions, and has incurred any additional debt as a result of the COVID-19 emergency. If the valuation does not satisfactorily address the impact of the COVID-19 emergency, the 7(a) Lender should consider requesting an updated business valuation.

Read More