Shocks Put Economy on Lowered Growth Path, Despite Expected Federal Reserve Cuts

ATLANTA–Trade tensions, a reduction in business investment and an earlier than usual presidential election swoon are contributing to a lowered growth path for 2020-21, according to Rajeev Dhawan of the Economic Forecasting Center at Georgia State University’s Robinson College of Business.

“Economic growth will take an oscillatory path, known as transition economics, to reach this lower level,” Dhawan wrote in his “Forecast of the Nation,” released Aug. 28, 2019.

“Economic growth will take an oscillatory path, known as transition economics, to reach this lower level,” Dhawan wrote in his “Forecast of the Nation,” released Aug. 28, 2019.

“There is never a single reason for a downgrade, but the chief culprit for this one and its zigzag is the evolution of business investment from mid-2018 until now,” Dhawan said. “Investment contractions are a bad sign for future growth unless there are mitigating circumstances.”

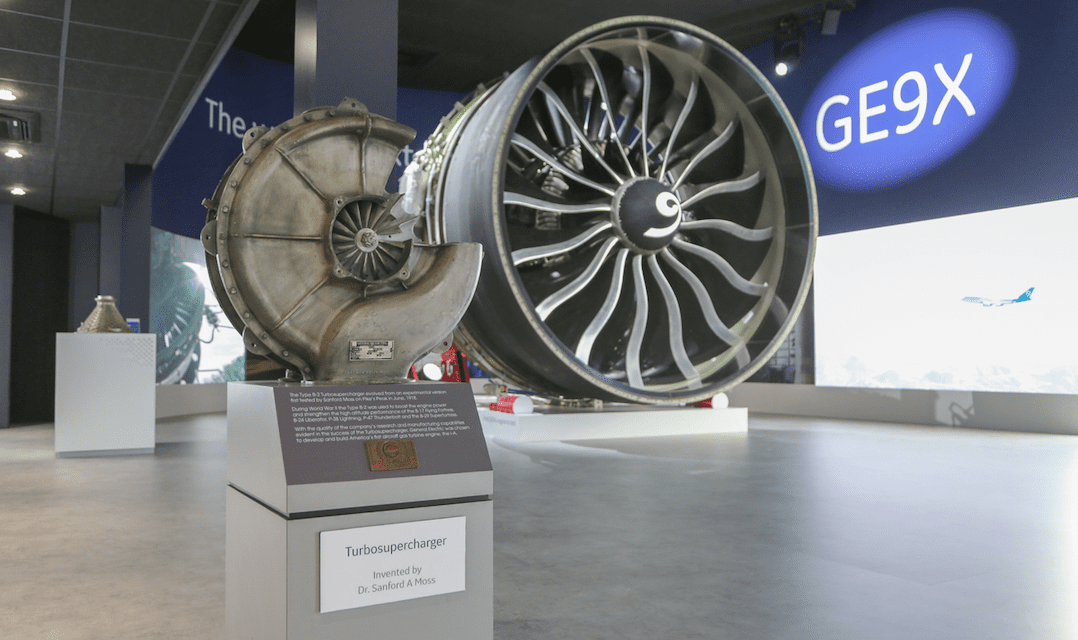

One such mitigating circumstance affecting equipment investment was the March grounding of Boeing’s 737 MAX, which has spread downstream to suppliers such as General Electric (engines) and numerous parts makers across the country.

“This investment category will rebound at some point, but don’t count on help from those parked planes before early next year,” Dhawan said.

Also in retreat: investment spending on structures (commercial buildings, mining and fracking wells) dropped 10.6 percent in the second quarter of the year.

“The commercial sector seems to be pulling back on its building desire, despite good consumer spending,” Dhawan said. “The reason is the future seems more uncertain today than a year ago, when tariffs were a negotiating ploy and not a reality, as they are now.”

As for fracking, low oil prices are keeping well below the breakeven price per barrel, which Dhawan attributes to lowered demand from China.

“It seems unlikely that U.S.-Chinese trade tensions will ratchet down anytime soon,” he said. “And corporations, with their globally integrated supply chains, are spooked by the tit-for-tat tariff game. Investment is not expected to rebound to its mid-2018 high following the December 2017 tax cuts.”

Dhawan expects the Federal Reserve will cut rates in September, and then pause to observe concrete evidence of the anticipated growth slowdown. He then expects the Fed will decrease rates again in December, leading to a limited boost in home refinancing activity.

“A sharp drop in the 10-year bond rate since the Fed’s rate cut of July 31 is mostly due to global capital seeking a safe haven,” Dhawan said. “What cannot be forecast is when this fear-motivated flight to safety will end. If the move to 10-year bonds persists it will further depress the growth trajectory and keep the yield curve inverted longer, which would require deeper (emergency) rate cuts by the Fed.”

Highlights from the Economic Forecasting Center’s National Report

- Overall GDP growth will be 2.3 percent in 2019, 1.7 percent in 2020 and 2.0 percent in 2021.

- Investment growth will be 2.9 percent in 2019, 1.7 percent in 2020 and then rise to 3.2 percent in 2021. Monthly job gains will moderate to 153,000 in 2019, drop to 118,600 in 2020 and gain 116,900 new monthly jobs in 2021.

- Housing starts will average 1.225 million in 2019, 1.228 million in 2020 and then increase to 1.265 million in 2021. Vehicle sales will average 16.7 million in 2019, 15.9 million in 2020 and 16.0 million in 2021.

- The 10-year bond rate will average 2.1 percent in 2019, 2.2 percent in 2020 and rise to 2.5 percent in 2021.

- percent in 2019, decline 6.0 percent in 2020 and fall another 3.0 percent in 2021.