Borrowing from Retirement Savings under CARES Act

John Mills

Concerned about your financial future due to the COVID-19 Crisis? John Mills of Tax Centers of Georgia told members of the GABB about ways you can borrow from your retirement savings without penalty and other tax strategies.

As the COVID-19 virus wreaks havoc on our personal life and financial markets, Mills discussed little known strategies to help businesses and individuals negotiate current financial hardships. The Georgia Association of Business Brokers (GABB) is hosting weekly meetings to answer members’ questions during this pandemic.

A recording of the presentation is linked here.

Mr. Mills, a partner in Tax Centers of Georgia, said that the CARES Act provides an unusual opportunity to get access to your 401k or IRA investments without age restrictions or penalties.

He said many tax experts think “average” income earners could be paying as much as 37-54% in taxes in the near future. He discussed how and investor could add hundreds of thousands dollars of tax-free cash flow to retirement income without any additional savings.

Under the CARES Act, who can get money out of a 401k and/or IRA? Anyone:

- Who is diagnosed with COVID-19 by a test approved by the Centers for Disease Control and Prevention.

- Whose spouse is dependent (generally a qualifying child or relative who receives more than half of his or her support from you) is diagnosed with COVID-19 by such a test.

- Who experiences adverse financial consequences as a result of quarantine, furlough, layoff, or having work hours reduced due to COVID-19.

- Who is unable to work because of lack of child care due to COVID-19 and experiences adverse financial consequences as a result.

- Who owns or operates a business that has closed or had operating hours reduced due to COVID-19 and has experienced adverse financial consequences as a result.

- Who has experienced adverse financial consequences due to other COVID-19 related factors to be specified in future IRS guidance.

COVID-19 401k/IRA Plan Details

- Loans will move from 50% or $50,000 to 100% or $100,000 that you can borrow. This options ends on September 23rd. Your plans loan rates can vary from other plans. You then pay back the loan over 5 years (this can be done with payroll deduction and dramatically increase your savings above the IRS rules).

- If you qualify (based on COVID-19 rules) you can withdraw up to $100,000. You will not be subject to the IRS under 59 ½ rule requiring a 10% penalty. End date for this is 12/31.

- If taken as a distribution, taxes owed can be spread over three years or you can choose to pay the taxes lump sum at the end of three years and skip the tax now.

- This is a one-time opportunity, Mills said.

Option #1: Loan

- Take up to a $100,000 loan from your 401k plan or any other lesser amount.

- Pay back the loan through payroll deduction over 5 years or, in a lump sum at the end of five years. Be your own bank! If you can afford more than the $20,000 limit of your normal contribution, you can now deposit $40,000 per year into your 401(k) (normal contribution plus loan each year.

- Your interest rate may be PRIME (currently about 3.25%). Each plan can vary on the rate, but rates are at an all time low.

- You now have $100,000 in your hands, income tax free.

- Just because you could take a loan, doesn’t mean you should, Mills advised.

Option #2: Distribution

- Take” the full $100,000 as a distribution from your 401k or IRA

- This could be the only time in your lifetime that you can get money out of your pre-tax account while under 59 ½ without a 10% penalty.

- The tax can be spread over three years (Due April 2021, 2022 and 2023)

- Assuming a 24% tax rate, that would mean only $8,000 in tax each year. This can be paid from savings or any other non-qualified investment you may have. If pay in 4 installments (1 immediate and 3 more over 2021-23) it would mean 4 installments of only $6,000.

- How does that benefit you to pay these small taxes over 3 years?

Alternative #1: Roth Conversions

- There is no limit on the amount you can convert from IRA or 401K to Roth

- The CARES ACT however limits the amount you can draw out of your IRA or 401k without the 10% penalty ($100,000 “per person”)

- The Roth will still have the 10% penalty before age 59 ½ and even if over that age you must hold the Roth for 5 years before accessing any of the money.

- Depending on where you invest the Roth money (Stocks, Bonds, Mutual Fds etc.) you still carry all the risk as you did in the 401(k).

What else can you do with the money?

- What if we could get the money to grow tax-deferred (the $100,000) and have it come out 100% Tax-FREE (like the Roth)?

- What if you passed away prematurely and your family then received a large sum, potentially 3 times the amount of money you took out, again…100% Tax-FREE?

- What if you had a chronic illness or required a Long-Term Care stay and you could have money to help cover your stay…100% TAX-FREE?

- What if you had a short-term financial need and you could access this same money again without any 10% governmental penalty or tax BEFORE age 59 ½ ?

Can I really do that?… YES

- Borrow OR take your distribution (or any part of the maximum) and place it in a 7702 plan using life insurance vehicles. Immediate potential benefit for your family should you pass of $336,000*

- Cash then grows tax-deferred and comes out tax free for your retirement or whenever you might need it **.

- Take your tax-free income for 10, 20 years or possibly longer in retirement.

- Receive proceeds in case of a chronic illness or Long-term care need…TAX-FREE.

- Cover a college education or wedding…TAX-FREE.

To find out more, Mills invites businesses and individuals to contact him.

Linked below is Mr. Mills’ PowerPoint presentation.

Cares Act Pwpt- .John Mills (1)-1

Read MoreCrisis Averted: 11 Steps to Help Your Business Survive and Thrive

Russ Hall, Action CoachExperienced business brokers know that there’s sometimes a gap between when a business owner wants to sell their business and actually having a business prepared to sell.

The Georgia Association of Business Brokers held its March 31 meeting online with more than 60 participants.

If you missed the meeting, you can view the recording here.

Business coach Russ Hall, our guest speaker, came to us using the Zoom virtual meeting platform. Mr. Hall offered advice on how small business owners can weather the current economic and health crisis. GABB affiliate and attorney Wendy Kraby talked about how loan closings are happening online, and SBA lenders discussed SBA loans available during the crisis and loan extension options.

The presentation from Russ’s excellent webinar, Crisis Averted,: 11 Steps To Help Your Business Survive and Thrive, is linked here: CRISIS AVERTED Webinar by Russ Hall for GABB

Since 2003, Mr. Hall has been a part of ActionCOACH, a global organization that helps the owners and teams of small businesses improve performance so that they can improve their lives. He spent his first seven years after university as a US Naval Aviator, and he piloted SH-3 Sea King anti-submarine warfare helicopters. He also spent 21 years with a Fortune 100 company in the Healthcare Technology sector, leading and managing national award-winning teams in Sales and Customer Service for most of that time. As a part of his development as a coach, he earned a Master’s in Industrial-Organizational Psychology from the University of Georgia.

Joining a Zoom Meeting

How do I join a Zoom meeting?

You can join a meeting by clicking the meeting link or going to join.zoom.us and entering in the meeting ID.

How do I join computer/device audio?

On most devices, you can join computer/device audio by clicking Join Audio, Join with Computer Audio, or Audio to access the audio settings.

Can I Use Bluetooth Headset?

Yes, as long as the Bluetooth device is compatible with the computer or mobile device that you are using.

Do I have to have a webcam to join on Zoom?

While you are not required to have a webcam to join a Zoom Meeting or Webinar, you will not be able to transmit video of yourself. You will continue to be able to listen and speak during the meeting, share your screen, and view the webcam video of other participants.

For more information about the GABB, contact GABB President Dean Burnette at dean@b3brokers.com or (912) 247-3209; or contact GABB Executive Director Diane Loupe at georgiabusinessbrokers@gmail.

The Silver Lining in the Coronavirus: Think Positive!

Photo by Skitterphoto from Pexels

By Dean Burnette, GABB President and managing broker of Best Business Brokers of Savannah

In the last few days my email has had a growing amount of Covid-19 Update emails! When I turn the television or radio on I hear or see “Corona virus” 100’s of times. Although coverage of a global pandemic is understandable, we’re only human.

If exposure to the virus doesn’t get us, hearing bad news may.

Being an eternal optimist with real life experience through several world economic cycles, including the oil embargo of the 1970’s and 1980’s, The Y-2-K threat of 2000, the real estate bubble, I’m quite confident that most of us will survive this. In fact, some will prosper and some will not.

There will be short term challenges. I have been personally impacted by the current travel challenges. One buyer was supposed to fly in from Chicago last week to look at a business, another client was supposed to fly down from Ohio, and they both had to cancel. I’m expecting a buyer from New York to fly into Savannah Saturday morning, and I’m wondering if he will actually make it?

Some will be impacted more than others; I hope we will be compassionate and aware of other’s struggles. As in the past, most people will come out the other side of this challenge better than they imagined. In each of these cycles, new industries were created!

New industries will be created; some will become obsolete.

We’ve all learned a new term with Covid-19, Social Distancing. I’ve long said that there are some people you have to love from a distance, and social distancing certainly puts a new spin on that! The world may never be the same again.

I am over 60, and so I am at a higher risk than the general population and should take extra precautions. With all the technological advances in communication and social media, I don’t know whether to feel safer or more vulnerable with my higher risk senior status. But I do know that in every crisis, there are possibilities, a silver lining in a rain cloud.

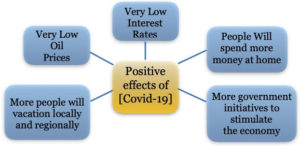

The positive side of the Covid-19 experience

This too shall pass and probably sooner than we imagine! The world is much better equipped to overcome pandemics and other challenges that come at us. We are currently witnessing in real time the wonders of technology and the benefits we have in this day and time.

Instead of dwelling on the negative aspects of our current world challenges, we can find the silver lining. For example, I have two clients who have been able to secure business loans because of the lowered interest rates. After being cooped up for a couple of weeks or longer I believe people will fill up their gas tanks with cheap gas and travel locally, spend money in small businesses. I hope we can use this time of solitude to appreciate our families more and get some of those closets, garages, or spring cleaning done.

Opportunities will emerge

Other bright spots:

Other bright spots:

- Gasoline prices are very low.

- Interest rates are at historic lows, creating many opportunities for economic growth through new manufacturing opportunities and business expansion.

- Instead of going on cruises and traveling to other countries, people will fill up their tanks and spend their money locally in small businesses. More people will drive to Savannah or visit the Atlanta Aquarium!

- Many companies are encouraging people to work from home during the crisis, and after the crisis many will continue working from home.

- We all have learned the best way to wash our hands, and we’re washing more frequently, and most of us will be more aware of our health and hygiene.

- Because of our new awareness of how much we depend on foreign companies for vital products, more manufacturing will be done here.

- New industries will be created and more jobs and business opportunities will result from this crisis.

If you have been considering buying or selling a business, the stars are lining up, interest rates are low, and the U.S. government will be putting extra efforts into economic stimulus. Gas prices are very low, and people will have more money to spend in local businesses. The list goes on. If you have been waiting for the right time to buy or sell a business, that time is now. It sometimes takes months to close a deal, by that time the virus will be history, and businesses will beginning to flourish again!

Read More

Compiling an Offering Memorandum: What Buyers Look For

Steve Mariani spoke to the GABB on Feb. 19, 2020. Photo by Roger Easley.

Stephen “Steve” Mariani, owner of Diamond Financial Services and a board member of the International Business Brokers Association (IBBA), spoke to business brokers this week about compiling a listing or offering memorandum.

In a lively talk, which you can hear online, Mariani talked about the top things that buyers look for in a business-for-sale listing, and what lenders look for in an offering memorandum, a detailed description of a business for sale.Buyers are also interested in the location of a business as well as whether there is growth potential in the industry, Mariani said. Financing options, especially owner financing, are very important.

After the price of the business, most buyers will want to know about its cash flow and seller’s discretionary earnings. While it may be common to have family members on the payroll, claiming a personal home mortgage as a business expense is likely to attract unwanted scrutiny from lenders. And lenders are required by law to report instances of flagrant tax fraud, he said.

Listings that go through the effort to be pre-qualified by lenders, or eligible for SBA loans, are automatically more attractive to buyers, Mariani said. That means an objective professional has examined the business’s financials and brings “immediate confidence in the numbers presented.”

“If the listing can service the debt at the asking price, then cash flow after debt service becomes apparent to a potential buyer,” Mariani told the brokers. “Most buyers understand this and calculate it for themselves.”

Today’s borrowers are learning that they can purchase much more cash flow than they once thought, he said. Most high net worth borrowers are looking to maximize their ROI by using financing options. In Mr. Mariani’s PowerPoint Presentation: Compiling Offering Memoranda, he covered items every lender will look for, including purchase price, working capital, SBA fees and closing costs, etc. The GABB, an IBBA affiliate, is the state’s premier organization dedicated to professionals who buy and sell businesses in Georgia.

What three things should be left OUT of your offering document? Avoid listing specific qualifications a potential buyer must have to purchase the business, because this could scuttle a sale, Steve said. Although most lenders like to see three years of direct or one year of related experience in a field, this varies greatly.

Avoid listing personal add backs. If more than 20 percent of the seller’s discretionary earnings comes from personal add backs, the lender will be concerned.

Designating anyone at the business as a “key” employee, i.e., one that is critical to the operation and success of the business, raises a lot of red flags, may necessitate a form 1919 or a “required” personal guarantee of the employee, Mr. Mariani said.

Mr. Mariani’s company has helped small business owners realize their dreams by funding more than $1 billion in acquisition loans during the past 24 years. Diamond has become the nation’s largest privately owned non-bank SBA acquisition loan generator that serves only the broker markets. Steve has also been producing and presenting broker training webinars and workshops for the last 11 years at various conference events.

After witnessing the difficulty and challenges some business buyers experienced securing business loans to acquire a business, Mr. Mariani learned the intricate, complicated world of the Small Business Administration (SBA) loan process. He mastered the SBA SOP (Standard Operating Procedure) rules and regulations and has become a major source for many national lenders. Business Brokers, lenders and owners nationwide seek Steve’s advice and he has become the “expert” in SBA loans. His understanding of SBA rules also allows for providing the most aggressive financing available nationwide.

The GABB is the state’s largest and oldest association of professionals who specialize in brokering the purchase and sale of businesses and franchises. Broker members help owners determine the asking price of their business, create marketing plans and strategies for selling their business, identify and qualify buyers, and have the knowledge, experience and skills needed to help maintain the confidential nature of the process. The professionals of GABB relentlessly pursue professional development so they can provide superior, ethical services for all customers and clients. Affiliate members include bankers, lawyers, appraisers, insurers and other professionals who work closely with brokers to help owners and buyers get to the closing table.

For more information about GABB, please contact GABB President Dean Burnette at 912-247-3209 or dean@b3brokers.com, or GABB Executive Director Diane Loupe at diane@gabb.org or 404-374-3990.

Read More

The Confidential Process of Marketing a Business

Selling a Business and the Role of a Business Broker

By Greg Younts, CMAI, GABB Broker

By Greg Younts, CMAI, GABB Broker

A unique challenge of selling your business is that you cannot advertise certain confidential details about the business, and yet you have to target and attract the attention of the right buyers. Specific details about the business such as business name, exact location and unique products or services offered typically cannot be revealed to the public. It could be disastrous if employees, customers, competitors or other third parties discovered the business is for sale. So, how do you confidentially market your business for sale and attract the attention of the right buyers? In an article for the Atlanta Small Business Network, Greg described several possible options for developing a successful confidential marketing plan for taking your business to market, and you develop a custom plan that will best fit your unique business.

Your marketing plan and associated marketing documents should highlight what is unique about your business without revealing so much information that you risk compromising confidentiality. Second, you identify who would be the most likely buyers and structure your marketing plan and message to get the attention of these buyers. The right buyer could be an individual, another business, Private Equity Group and/or other possible groups of investors. And third, you determine the best strategy to get in front of your potential buyers.

If an appropriate method for taking your business to market is to advertise to the public; using business listing websites, business trade journals, trade shows or any other appropriate advertising medium can be effective. Or, a more targeted marketing strategy might be best for your business. You may know specific buyers who would be interested in your business, and industry research can be performed to identify a list of potential buyers within your industry. In this targeted approach, the best strategy may be a proactive direct mail and phone campaign to contact this group of buyer prospects. It also might be appropriate to execute a broader strategy that includes both public advertising and targeting a select group of buyer prospects.

Regardless of the marketing strategy that is right for your business, key tools that could be used in this process are some form of public advertisement and/or business profile that is often referred to as the “blind profile”. The profile is blind because it does not reveal confidential information, but does provide key facts about the operations and financial performance of the business that buyers need to see. Multiple versions of the blind profile might be required for your business if different types of buyer prospects are contacted. A blind profile typically contains more information about your business than a public ad. It is often sent to a buyer after they respond to an ad and is sometimes included with a letter in a direct mail campaign.

The most widely used form of public advertising for businesses on the market are the business listing websites. The Georgia Association of Business Brokers maintains a website where its members list businesses for sale in Georgia, and other businesses for sale by GABB brokers. This site and others allow business owners the flexibility to provide a comprehensive profile of their business without disclosing confidential information. Buyers mau search for businesses by criteria such as type of industry, geographic location, sale price, annual revenue, cash flow, availability of owner financing, etc.. And, there is the option to search by keywords to find a very specific type of business.

An experienced business broker knows how to write a listing site ad that will best describe your business such that it will be found and read by the right buyers. Too often, business owners provide a very poor description of their business. In my experience, business buyers are often frustrated by how difficult it is to find businesses that are accurately described with the key information they need to see if it is a business they want to pursue. This is one of the major reasons why some businesses do not generate strong buyer interest or catch the attention of the right buyers on listing sites.

Experienced business brokers and M&A professionals can help you develop a marketing plan and the related documents. They know how best to describe your business in an advertisement and blind profile, and make sure it reaches the right buyer audience. They know what appeals to buyers and how to make your business standout as an exceptional acquisition opportunity. They know how to impress and capture the attention of C-level executives, Private Equity Groups and individual buyers. And, as buyers express interest in the business, brokers know how to engage with buyers to further determine if they are qualified in terms of background, skills, experience, interest level and financial profile.

Top business brokerage and M&A firms have marketing and industry research staff to support their brokers in developing the marketing plan, blind profile and other marketing documents that will be used for their clients. They have access to various sources of industry data sometimes needed for identifying a list of potential buyers for a business. These firms have also developed several third party relationships that give their clients the best and broadest possible exposure to top buyers in the marketplace. They have relationships and affiliations with various state, national and international Business Brokerage and M&A associations. And, they are in contact with thousands of Private Equity Groups, corporations and other possible sources of buyers.

The successful confidential sale of your business largely depends on developing and executing the right marketing plan for your unique business. Failure to take a business to market the right way has resulted in businesses not selling or businesses being sold well below market value. If you are selling your business and need expert guidance through the confidential process, you should consider the services of a business broker. The investment in the services of a business broker could result in recognizing an after-tax gain on the sale of your business that will easily justify the broker’s fee.

Greg Younts is a Certified M&A Intermediary and has more than 30 years of experience working for companies in sales, marketing, and management capacities. He started his career in the information technology field where he focused on the design and sales of strategic technology solutions to meet the needs of companies that range in size from small business to the Fortune 100. He has served companies in every major industry throughout North America.

Read More