Pandemic Will Impact Business Valuations

The COVID-19 pandemic is going to affect the valuation of businesses, and professionals are likely to take into account a wider number of factors when determining the fair market value of a business.

That’s what two business valuation experts told the Georgia Association of Business Brokers in a conference call on Tuesday, May 26. Dan Browning is the founder and President of DB Consulting, Inc. and David H. Hern, CPA/ABV, ASA, CEPA, a financial analyst with Sofer Advisors spoke to the GABB online. View the conference online here.

“The biggest issue is uncertainty, which heightens the risk, and higher risk leads to lower value,” Browning said. People who assign values to businesses are, by their nature, trying to predict future business conditions, which is tricky anytime, but particularly now. While many businesses have suffered, some businesses “have gone gangbusters,” Browning said. The cost of capital has actually gone down for some businesses, specifically those that have been able to obtain SBA-backed assistance in the form of grants or low-interest loans.

However, some valuation clients are “taking advantage of uncertainty,” Hern said. Some clients are using this time to “do tricky estate planning, issue equity grants, possibly get values frozen below normal,” he said.

If a business valuation was triggered before the onset of the pandemic in the US, some will argue it’s a subsequent event, and should not affect the pre-crisis value. Browning said he has started including an appendix, a disclaimer, calling COVID-19 a subsequent event, which didn’t affect value as of the valuation date.

Browning shared a timeline from respected business valuation expert Jim Hitchner who tracks the impact of the virus on various markets.

Hern shared a Sofer analysis of the mobility of the U.S. Market Mobility of US Market Sofer document

Restaurants have been seriously impacted by the crisis, and many are trying to decide whether it’s worth reopening. Some, like pizza restaurants, have adapted better to a takeout model.

Restaurant broker Dominique Maddox said many of his clients are opting not to reopen and are trying to sell their assets and get out from a multi-year lease. Pizza concepts were able to keep going strong, Maddox said.

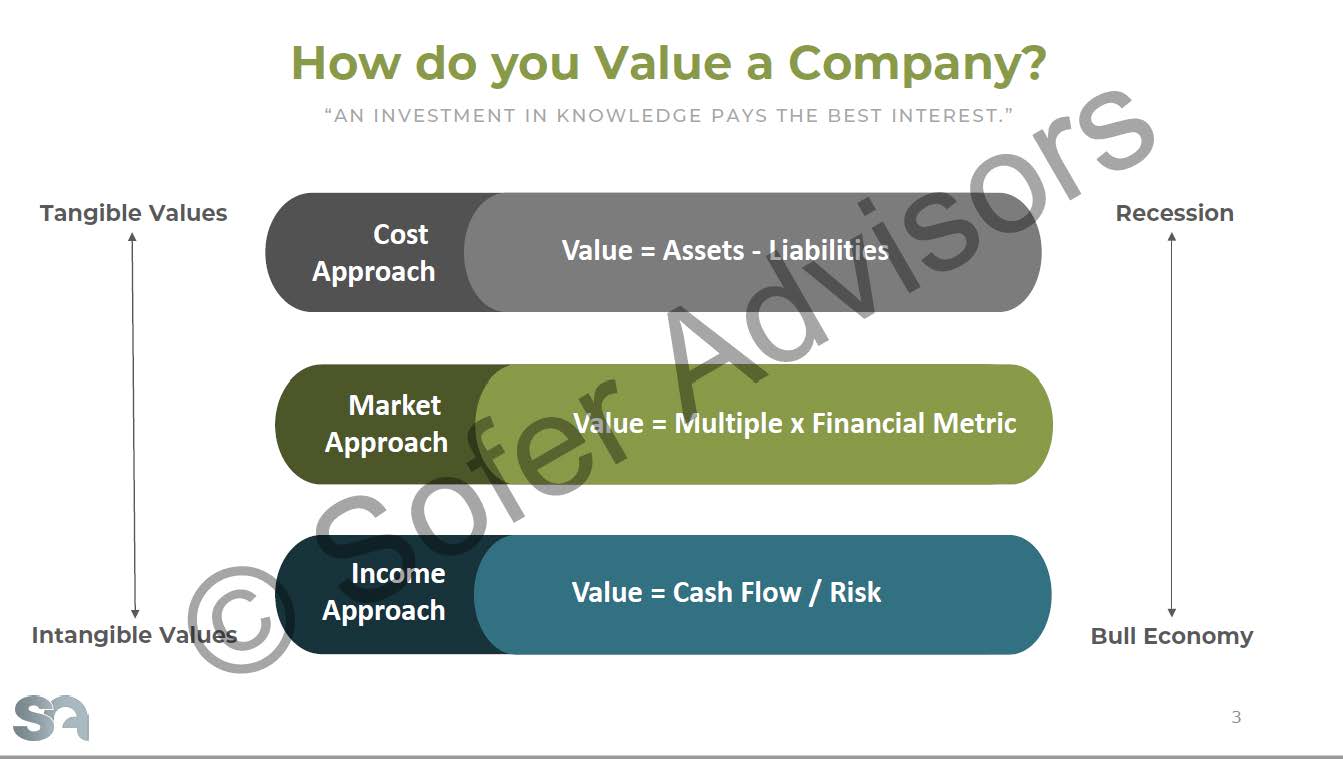

Hern cited three approaches to business valuation: Cost Approach, in which the value of the business is equal to their assets minus liabilities. The Market Approach determines the value of a business based on a multiple and a financial metric. The Income Approach sets the value at cash flow divided by risk.

Hern cited three approaches to business valuation: Cost Approach, in which the value of the business is equal to their assets minus liabilities. The Market Approach determines the value of a business based on a multiple and a financial metric. The Income Approach sets the value at cash flow divided by risk.

The methods skew towards tangible values during a recession, and during bull economy tends to more intangible values. Hern says he’s been running a variety of scenarios taking into account whether the economic recovery may be V-shaped, U-shaped or something else. Browning predicted a W-shaped recovery, with ups and downs.

Businesses may be getting valuations that specify a range of values instead of a single value, Browning said.

“It’s important not to get too negative,” Browning said. “There is a going to be a recovery, there is going to be coming out of all of this.” The recovery may be bumpy, but it will come.

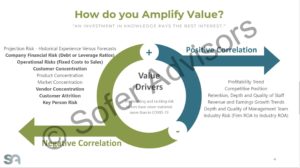

Hern is recommending that business owners prepare their businesses to be in the best shape for the future, fixing problems. You can amplify value by reducing the customer concentration, reducing debt, improving their competitive position, improving staff depth and retention, etc.

“Companies that have fixed these types of issues will sell for better value,” Hern said.

Hern said he will be looking at vendor concentration in the future when valuing a business.

“Doing business is going to be more expensive going forward,” said Browning. Businesses are going to have to buy extra cleaning supplies, extra protective gear, more training of employees.

Hern’s presentation: GABB Sofer

Dan Browning is the founder and President of DB Consulting, Inc. His credentials include:

Dan Browning is the founder and President of DB Consulting, Inc. His credentials include:

- Master Analyst in Financial Forensics (MAFF) from the National Association of Certified Valuators and Analysts, originally awarded August 1999

- Accredited in Business Appraisal Review (ABAR) from the National Association of Certified Valuators and Analysts, originally awarded March 2010

- Georgia Association of Business Brokers (Affiliate Member)

- State Bar of Georgia (Active Member; Eminent Domain and Nonprofit Law Section Memberships)

- Editorial Board, Business Appraisal Practice (IBA Journal) 2013-2015

- University of Notre Dame, Master of Arts (Government), January 1995

- Emory University School of Law, Juris Doctor, May 1992

- Emory University, Bachelor of Arts, May 1985; Phi Beta Kappa

David H. Hern, CPA/ABV, ASA, CEPA, is a highly qualified financial analyst with Sofer Advisors.He has exceptional credentials in determining the true, comprehensive value of an organization. In addition, he has something even more rare: a proven ability to simply and clearly communicate analysis to boards of directors, legal and financial advisors, Company management (CEOs, CFOs, controllers, etc.) and private equity portfolio managers. Mr. Hern offers litigation assistance, estate and tax planning, and business enterprise valuations for various privately-held and public companies. He has been recognized for enabling organizations to determine their enterprise and equity value for a variety of situations

David H. Hern, CPA/ABV, ASA, CEPA, is a highly qualified financial analyst with Sofer Advisors.He has exceptional credentials in determining the true, comprehensive value of an organization. In addition, he has something even more rare: a proven ability to simply and clearly communicate analysis to boards of directors, legal and financial advisors, Company management (CEOs, CFOs, controllers, etc.) and private equity portfolio managers. Mr. Hern offers litigation assistance, estate and tax planning, and business enterprise valuations for various privately-held and public companies. He has been recognized for enabling organizations to determine their enterprise and equity value for a variety of situations

Education

- Georgia Institute of Technology, Scheller College of Business, Atlanta GA. Masters of Business Administration, Finance emphasis.

- Georgia Institute of Technology, Scheller College of Business, Atlanta, GA. Bachelors of Science, Management with Accounting emphasis.

Certifications

- Certified Public Accountant (CPA) — State of Georgia

- Accredited in Business Valuation (ABV)

- Accredited Senior Appraiser (ASA)

- Certified Exit Planning Advisor (CEPA)

Read More

An Unexpected Symptom of COVID-19 – Impairment Expense

By David Hern, CPA/ABV, ASA, GABB Affiliate and financial analyst

If you haven’t heard of COVID-19 or Coronavirus–or as my 6-year-old refers to it, the ball with red broccoli on it–then you’ve been living under a rock. Regardless of your quarantine efforts, your business is experiencing a severe coronavirus symptom that could have a major impact on your 2020 financials and audit. For any company that completed an M&A transaction in the last few years, large impairment expenses are likely to occur by this time next year.

COVID-19: my 6-year-old refers to it as the ball with red broccoli on it

Many companies are in the throes of their 2019 audits and are thankful they do not have to pile yet another item on their to-do list. These same companies are probably finishing up purchase price allocations (PPAs) for ASC 805 – Business Combination accounting from deals completed in 2019. However, CFOs and Controllers across the US need to be developing and saving their current COVID-19 financial projections immediately. Why? For starters, many of these companies likely chose to switch to amortizing goodwill over a 10-year period after completing their PPA. What these executives do not realize is just because you are writing off intangible assets does not mean they do not need to be tested for impairment. U.S. generally accepted accounting principles require you to test your goodwill for impairment expense under FASB ASC 350 if there has been a “trigger event.” I can promise you every auditor worth their salt across this great land is going to define a global pandemic which we’ve not seen the likes since the Spanish Flu will as a “trigger event.” At one point, the major stock indices were down well over 30% from their highs.

There are several triggering events noted in ASC Topic 350 that could apply including:

- Macroeconomic conditions such as a deterioration in general economic conditions,

- Overall financial performance such as a negative or declining cash flows or a decline in actual or planned revenue or earnings,

- A sustained decrease in share price, etc.

Consequently, valuation analysts will have to be engaged to determine if a decline in fair values of various reporting units are below their carrying amounts resulting in an impairment expense. Sofer Advisors would be happy to talk with you about your unique circumstances and how they may be a triggering event. Please contact us for a free consultation.

David H. Hern, CPA/ABV, ASA, of Sofer Advisors is a highly qualified financial analyst. He has exceptional credentials in determining the true, comprehensive value of an organization. In addition, he has something even more rare: a proven ability to simply and clearly communicate analysis to boards of directors, legal and financial advisors, company management (CEOs, CFOs, controllers, etc.) and private equity portfolio managers.

It’s Time to Exit. Are you Ready?

Thinking about whether or not you are ready to sell your business is an important question. It’s something that every business owner will have to address at some point. Importantly, there are far too many pieces in this particular puzzle to wait until the last minute to prepare an exit plan. You’ll want to begin the process sooner by asking yourself some key questions.

Determining Value

First, you’ll need to determine the actual value of your business. It is a harsh truth, but the market may think your business is worth less than what you think it’s worth.

This is where it pays to work with a business broker or M&A advisor early in the process. An experienced broker knows how to determine a price that will generate interest from buyers and seem fair. Yes, it will be the marketplace that determines the value of your business, but working with a seasoned professional is an excellent way to match your offering price with what the market will ultimately bear.

Going Within

Second, you’ll want to consider whether or not you truly want to sell. Many business owners begin the process of selling their business only to realize a few hard facts. Upon placing your business on the market for sale, you may learn that you’re not emotionally or financially ready. Wanting to sell and the time being right to sell are often two different things. If this happens to you, consider it a learning experience that will serve you well down the line.

Get Your Ducks in a Row

After you’ve done a financial assessment, a little soul searching and have begun working with a professional, and have determined that this is a good time to sell, there are several steps you’ll need to take. You can be sure that any serious prospective buyer will want a good deal of information regarding your company.

Topping the list of items potential buyers will want to see are three years of profit and loss statements as well as federal income tax returns for the business. Other important documents you’ll need to provide are lease and lease-related documents, lists of loans against the business and a copy of a franchise agreement, when applicable. You should also have a list of fixtures and equipment, copies of equipment leases, lists of fixtures and equipment, and an approximate amount of inventory on hand. Failing to have this information organized and ready to present at a moment’s notice could be a costly mistake.

Working with professionals, such as accountants, lawyers, and brokers, is a savvy move. Owning and operating a business can be a complex process, and the same holds true for selling a business. Investing the time to seek out experienced and professional advice is the first step in selling your business.

What Would Your Business Sell For?

Business owners who are preparing to sell their businesses always want to know how much their company will bring on the market. Often they have an idea of what they think the business is worth, but that price is often high.

There is the old anecdote about the immigrant who opened his own business in the United States. Like many small business owners, he had his own bookkeeping system. He kept his accounts payable in a cigar box on the left side of his cash register, his daily receipts – cash and credit card receipts – in the cash register, and his invoices and paid bills in a cigar box on the right side of his cash register.

When his youngest son graduated as a CPA, he was appalled by his father’s primitive bookkeeping system. “I don’t know how you can run a business that way,” his son said. “How do you know what your profits are?”

“Well, son,” the father replied, “when I came to this country, I had nothing but the clothes I was wearing. Today, your brother is a doctor, your sister is a lawyer, and you are an accountant. Your mother and I have a nice car, a city house and a place at the beach. We have a good business and everything is paid for. Add that all together, subtract the clothes, and there’s your profit.”

That accounting method won’t help you to sell your business, however,

A commonly accepted method to price a small business is to use Seller’s Discretionary Earnings (SDE). The International Business Brokers Association (IBBA) defines SDE as follows:

Discretionary Earnings – The earnings of a business enterprise prior to the following items:

-

income taxes

-

nonrecurring income and expenses

-

non-operating income and expenses

-

depreciation and amortization

-

interest expense or income

-

owner’s total compensation for one owner/operator, after adjusting the total compensation of all other owners to market value

Here are some terms as defined by the IBBA:

-

Owner’s salary – The salary or wages paid to the owner, including related payroll tax burden.

-

Owner’s total compensation – Total of owner’s salary and perquisites.

-

Perquisites – Expenses incurred at the discretion of the owner which are unnecessary to the continued operation of the business.

Developing a Multiplier

Once the SDE has been calculated, a multiplier has to be developed. The following (just as a guideline) should be rated from 0 to 5 with 5 being the highest. For example, if the business is a highly desirable business in the current market, “desirability” would be rated a 4 or 5. If the business is in an industry that is quickly declining or nearly obsolete, “industry” would be given a 0 or 1 rating.

Age: Number of years the seller has owned and operated the business.

- Terms: Is the seller willing to offer terms? For example, will the seller accept 40 percent as a down payment with the seller carrying back 60 percent at terms the business can afford while still providing a living for the buyer?

- Competition: Consider the local market.

- Risk: Is the business itself risky?

- Growth trend of the business: Is it up or down?

- Location/Facilities

- Desirability: How popular is the business in the current market?

- Industry: Is the industry itself declining or growing?

- Type of business: Is the business type easily duplicated?

The average business sells for about 1.8 to 2.5. Obviously, if the SDE is solid and the multiple is above average, the price will be higher. Keep in mind that the price outlined includes all of the assets including fixtures and equipment, goodwill, etc. It does not include real estate or saleable inventory. The price determined above assumes that the business will be delivered to the buyer free and clear of any debt.

Veteran Wisdom

When all else fails, the words of a veteran business broker will work.

Asking Price is what the seller wants.

Selling Price is what the seller gets.

Fair Market Value is the highest price the buyer is willing to pay and the lowest price the seller is willing to accept.

Sellers should keep in mind that the actual price of a small business is usually about 80 percent of the seller’s asking price. A professional business broker will be familiar with the best way to price your business so that it sells.

Read More

What Kind of Business Seller Are You?

By Peter Siegel, MBA, Founder and President of BizBen.com.

Almost everyone who owns a company wants to put it up for sale sooner or later. And if the owner doesn’t have employees or family members ready to put up the money and take over the business, the owner must find a buyer in the business-for-sale market. Sadly, only one-third of the hopeful sellers in this market will be successful.

That means two-thirds of owners unable to connect with a buyer will ultimately have to close the business or give it away. The problem may be that the business simply is not desirable. But just as frequently, the reason an owner can’t make a sale is because he or she is one of the many seller types who inevitably will fail.

If the seller can identify what type of seller they are, they can gauge their chances of successfully selling their business.

1. Make a Killing Mike: Also known as “Make a Million, Mike,” this individual believes his business is worth more than any sensible buyer will pay for it. There are a number of ways Mike justifies the asking price. A popular idea is that a similar business recently sold for the price Mike wants. But no two businesses are alike, and Mike doesn’t understand that the “similar” business is much more profitable and in a better location. The market may not reward Mike if he should eventually lower the price to a figure close to its value. Buyers often are not interested in investigating a business that has been on the market for a long time – whatever the reason.

2. Clarence Can’t Carry: An important selling feature of most any business offering is the willingness of the seller to “carry back” part of the purchase price. Along with a cash down payment, the seller receives a promissory note usually secured by the business assets, to be paid off by the buyer over a period of time. It’s reassuring for a buyer when the seller is willing to help finance, because it demonstrates that the seller believes in the business and in the buyer’s ability to operate it successfully. An offering that can only be purchased with all cash is almost always unappealing compared to other opportunities that come with seller financing.

3. Rita Rosy Picture: According to Rita, her business is about to become as much in demand as this week’s most popular show business celebrity. She has the best inventory in town, the most helpful and loyal employees, and greater prospects for the future than any buyer can imagine. Even a business that does excel in some respects has its problems and disadvantages. Buyers know that and often don’t feel secure about an opportunity that is described only in the most optimistic way. When meeting with a seller who doesn’t come across as honest and credible, many buyers get a negative feeling about the opportunity – the opposite of what the seller intended.

4. Nick Not Ready: Any prospective buyers meeting Nick will wonder how he could be trying to sell his business but not be able to produce current financial information, a list of assets to be included, or a definitive description about the premises lease that the landlord will provide to a new owner. Does the seller have something to hide? Is he really that disorganized? If so, what does that say about the condition of the business? Did he neglect to “get his stuff together” because he doesn’t really believe the business is salable? These are questions that occur to buyers as they decide they aren’t interested in what Nick has to offer.

5. Don’t Worry Dorothy: When Dorothy tells a prospective buyer that he or she shouldn’t worry, the buyer usually worries. Buyers want to know what happens if the customer who accounts for half the company’s income decides to do business elsewhere. They want to understand the consequences if a large competitor moves into the neighborhood. If the seller can’t answer these questions, the buyers really won’t worry about those issues. That’s because they’ll look for another business to buy.

6. Secret Sam: One of the things Sam likes to tell prospective buyers is how much of the company’s income goes directly into his pocket without being recorded on the books. He may be proud of his skimming habit. He may think he’s quite clever at fooling the taxing authorities. He might think the buyer will add the total of unreported cash to the reported income and decide the business is making enough money to justify the asking price. But he’s mistaken. The buyers who investigate Sam’s business soon realize he can’t be trusted and move on to find out about other opportunities.

7. Realistic Ralph: Since he is motivated to sell, Ralph wants to present his business in a way that will generate positive responses from buyers. He understands he needs to be proactive in preparing the business for sale. The asking price accurately reflects market conditions. His books are in order and ready to be investigated by qualified buyers. Ralph met with financial institutions with the help of a niche financial advisor who specializes in business purchase financing. The business has been prequalified for financing. And Ralph is willing to carry back 20% of the price with a note. And he’s hired a professional business broker from the Georgia Association of Business Brokers who can develop a confidential plan to market his business to qualified buyers. His approach is a clear recipe for selling success.

If you identify with any of the first six seller types, you’re limiting your chances of selling your business. But if you assume the characteristics of Realistic Ralph, your business is likely to be among the one-third of business offerings that result in a sale.

About The Author: Peter Siegel, MBA is the Founder and President of BizBen.com. He is a SBA SCORE Counselor, author, consultant/coach (ProBuy, ProSell Programs), and advocate on the topic of buying and selling small to mid-sized businesses in the California marketplace. Having writen three books and hundreds of publication articles he has assisted small business owners/sellers, business brokers, agents, and business buyers for over 25 years. This article was adapted from one that originally appeared on his blog.

Read More