Business and Real Estate Closings during Coronavirus sheltering

Wendy Kraby

Are Closings Happening?

By Wendy W. Kraby, Senior Associate, GDCR Attorneys at Law.

With social distancing and work-from-home realities, are business and real estate closings even happening during the Covid 19 concerns?

As of the date of this writing, both business and real estate closings in Georgia are able to be processed during this time. However, parties need to be patient, flexible and proactive. The overall situation is very fluid and requirements and restrictions are rapidly changing.

Banks, accountants, law firms and other professional offices are — by and large — up and running. However, some services may be temporarily delayed as offices balance their work staff. Many employees are working from home, using their personal cell or home phones, so note that your caller ID may not be picking up the true caller.

Last week, my phone noted that I was getting calls from a “Rodney” in New York. I assumed it was a sales call or wrong number. Turns out it was a bank officer with Chase Bank calling to discuss resolving a client’s legal issue. I had eagerly been awaiting a call from the bank.

“I’m so sorry to call from my personal home,” Rodney said as his dog barked in the background, “but our entire staff is working remotely right now.”

We resolved the issue and I was told that I would be sent a follow up letter confirming our agreement. However, Rodney said the letter would take about two weeks or more to come, because he was unsure who was in the office to physically mail it.

We both lamented that this is our reality. But ultimately, the issue was resolved, and the client was pleased.

Note that other than closings in which documents need to be signed, law firms and other professionals have quickly moved to almost all meetings being by phone conference or video conferencing.

Conducting Closings

When closing a real estate deal, the requirement is to record in the public records any property transfer deeds or financing liens as soon as possible after closing. However, with many Georgia courthouses closed to outsiders or closed completely for cleaning (such as DeKalb County), how are original documents to be submitted for recording? Most counties in Georgia are now able to accept online filing of deeds and most law firms and title companies have transitioned easily to this. For, counties that do not have online filing or who are not able to accept mailed deeds for recording, major title companies have stated that they will insure over the “recording gap” (the time between when a deed was signed and when it is recorded in the public records) with signed indemnities from the parties involved.

While some closing documents, such as closing statements, can be signed remotely, real estate deeds and security deeds in Georgia normally must be signed, witnessed and notarized in person. That is, the signer, witness and notary should all be in the same room and actually see the signing take place. On March 31, the Georgia governor issued an order to allow video notary signing under certain conditions.

At our firm, we schedule closings to make sure there is only one closing at a time in the office, which closings take place in a designated open-air area that is sanitized before and after each closing. We have the signer, witness and notary (and attorney) each sit at the same table, but separated to different corners of the large table, each with their own blue pen. Proper social distancing is maintained, and we have set up so that only one “touch point” to allow people into the building is needed.

There is no legal requirement that Seller and Buyer sign at the same time or even sign in the same room.

For a recent closing in which we represented the Seller, she signed in our office the day before closing and we sent her documents via overnight delivery to the closing attorney, who had the Buyers come into the closing office the next day. The closing proceeded with no issues and the bank wires were delivered quickly.

According to Georgia law (O.C.G.A. § 10-12-7), parties to a contract (not a land deed) can sign electronically through an app or program. I do not recommend this unless both parties have a provision in the contract that signing electronically is specifically permitted. Proving in a Georgia court of law that someone has actually signed a document electronically is not well established. For real estate and business closings, there are typically numerous documents to be signed. It is still recommended that closing documents be hand-signed by the parties.

To date, our firm has found lending institutions to be very willing to move forward with previously scheduled closings – both for real estate and business purchases. I recently spoke to the president of a local community bank who said, while it did not let the community inside the bank without an appointment, the bank is very much open and still lending — although some employees are working from home.

Wendy W. Kraby is a business and land development attorney at Gregory, Doyle, Calhoun & Rogers, LLC in Atlanta and is an affiliated professional member of GABB. https://www.gdcrlaw.com/wendy-w-kraby

Read More

Join a GABB Zoom Meeting To Discuss Crisis

https://zoom.us/j/377490963

GABB March 31 Meeting ID: 377 490 963

Meeting ID: 424 107 190

Meeting ID: 472 789 564

+1 929 205 6099 US (New York)

+1 312 626 6799 US (Chicago)

+1 301 715 8592 US

+1 346 248 7799 US (Houston)

+1 669 900 6833 US (San Jose)

+1 253 215 8782 US

Joining a Meeting

How do I join a Zoom meeting?

You can join a meeting by clicking the meeting link or going to join.zoom.us and entering in the meeting ID.

How do I join computer/device audio?

On most devices, you can join computer/device audio by clicking Join Audio, Join with Computer Audio, or Audio to access the audio settings.

Can I Use Bluetooth Headset?

Yes, as long as the Bluetooth device is compatible with the computer or mobile device that you are using.

Do I have to have a webcam to join on Zoom?

While you are not required to have a webcam to join a Zoom Meeting or Webinar, you will not be able to transmit video of yourself. You will continue to be able to listen and speak during the meeting, share your screen, and view the webcam video of other participants.

SBA Low-Interest Loans for Small Business Owners

As the country faces the challenges related to the Coronavirus (COVID-19), SBA lenders in the Georgia Association of Business Brokers say they are still in business, approving loans, and can provide information about the SBA’s Economic Injury Disaster Loans.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act just passed by Congress includes programs and initiatives intended to assist business owners with whatever needs they have right now. Details included at this link.

Information about available loans is changing daily, so anyone with any questions about SBA loans available should contact a GABB Affiliate lender, and GABB will try to update information here as it becomes available.

“The SBA Team at Atlantic Capital is here as a resource to help businesses access the capital they need to continue to run and grow their companies,” says Thomas Rockwood, Vice President of SBA Lending at Atlantic Capital Bank.

Atlantic Capital, Cheryl Beer, Senior Vice President of SBA Lending at the Piedmont Bank, and other GABB affiliates who are SBA lenders say are still approving new loans for borrowers and fully participating in all of the U.S. Small Business Administration (SBA) loan programs designed to assist small business owners. These valuable GABB affiliates are still providing businesses access to capital through the SBA 7a, 504, and Express loan programs, including the Veterans Advantage loans, Woman-owned business loans, and programs for minority-owned businesses.

GABB Board member Kim Eells, Senior Vice President of SBA Business Development at Georgia Primary Bank, said as of March 18, the State of Georgia has been added as a declared state for Coronavirus Disaster Loan Assistance with the SBA. Businesses that have been adversely affected by COVID-19 may now apply for Disaster Assistance directly with the SBA, no banks involved, Eells said. These loans are up to $2,000,000, up to 30 year term, fixed rate of 3.75%. Apply online at: www.sba.gov/disaster.

“I was just on a training/conference call with SBA regarding the disaster loans,” Eells said. “They are going to make it as painless and fast as possible for the borrowers. They said everyone should apply, apply, apply.”

U.S. Small Business Administration is providing low-interest federal disaster loan funds for working capital to small businesses and private, non-profit organizations suffering substantial economic injury as a result of COVID-19.

SBA’s Economic Injury Disaster Loans:

- Offer up to $2 million in assistance

- May be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the

disaster’s impact - Interest rate is 3.75% for small businesses

- Interest rate for non-profits is 2.75%

- Offer terms up to a maximum of 30 years (determined on a case-by-case basis)

Ryan Stoll, Vice President SBA Banker, at Cadence Bank, provided this PDF with more details about the SBA loan program.

Webinar material-Coronavirus 03.14.20

“These funds are intended to replace lost sales or profits or for expansion for those businesses directly affected by the Covid 19 virus.,” said Susan Kite, Senior Vice President of SBA Business Development at Georgia Primary Bank. Susan has also posted information about the loans on the GABB member forum.”We are still making business acquisition loans at Georgia Primary Bank!”

For more information, please contact the SBA Disaster Assistance Customer Service Center. Call 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov.

Carolyn Robinson, a Senior Vice President at Acclivity Financial, A Subsidiary of Citizens Bank, said her bank is helping “our borrowers who want a loan payment deferment. We are continuing to underwrite, process and close loans.”

Carolyn provided additional details about the three-step process for applying for SBA disaster loans.Three_Step_Process_SBA_Disaster_Loans

The GABB encourages small businesses to contact one of the many SBA lenders in our association because these lenders have a proven track record of successfully working with business owners.

“We hope that all of you stay safe and healthy in the coming weeks and months,” said David Brindley, Vice President of Live Oak Bank. “Together, we will get through this challenging time!”

Read More

The Silver Lining in the Coronavirus: Think Positive!

Photo by Skitterphoto from Pexels

By Dean Burnette, GABB President and managing broker of Best Business Brokers of Savannah

In the last few days my email has had a growing amount of Covid-19 Update emails! When I turn the television or radio on I hear or see “Corona virus” 100’s of times. Although coverage of a global pandemic is understandable, we’re only human.

If exposure to the virus doesn’t get us, hearing bad news may.

Being an eternal optimist with real life experience through several world economic cycles, including the oil embargo of the 1970’s and 1980’s, The Y-2-K threat of 2000, the real estate bubble, I’m quite confident that most of us will survive this. In fact, some will prosper and some will not.

There will be short term challenges. I have been personally impacted by the current travel challenges. One buyer was supposed to fly in from Chicago last week to look at a business, another client was supposed to fly down from Ohio, and they both had to cancel. I’m expecting a buyer from New York to fly into Savannah Saturday morning, and I’m wondering if he will actually make it?

Some will be impacted more than others; I hope we will be compassionate and aware of other’s struggles. As in the past, most people will come out the other side of this challenge better than they imagined. In each of these cycles, new industries were created!

New industries will be created; some will become obsolete.

We’ve all learned a new term with Covid-19, Social Distancing. I’ve long said that there are some people you have to love from a distance, and social distancing certainly puts a new spin on that! The world may never be the same again.

I am over 60, and so I am at a higher risk than the general population and should take extra precautions. With all the technological advances in communication and social media, I don’t know whether to feel safer or more vulnerable with my higher risk senior status. But I do know that in every crisis, there are possibilities, a silver lining in a rain cloud.

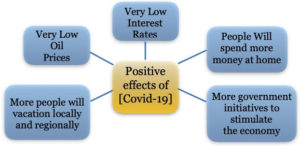

The positive side of the Covid-19 experience

This too shall pass and probably sooner than we imagine! The world is much better equipped to overcome pandemics and other challenges that come at us. We are currently witnessing in real time the wonders of technology and the benefits we have in this day and time.

Instead of dwelling on the negative aspects of our current world challenges, we can find the silver lining. For example, I have two clients who have been able to secure business loans because of the lowered interest rates. After being cooped up for a couple of weeks or longer I believe people will fill up their gas tanks with cheap gas and travel locally, spend money in small businesses. I hope we can use this time of solitude to appreciate our families more and get some of those closets, garages, or spring cleaning done.

Opportunities will emerge

Other bright spots:

Other bright spots:

- Gasoline prices are very low.

- Interest rates are at historic lows, creating many opportunities for economic growth through new manufacturing opportunities and business expansion.

- Instead of going on cruises and traveling to other countries, people will fill up their tanks and spend their money locally in small businesses. More people will drive to Savannah or visit the Atlanta Aquarium!

- Many companies are encouraging people to work from home during the crisis, and after the crisis many will continue working from home.

- We all have learned the best way to wash our hands, and we’re washing more frequently, and most of us will be more aware of our health and hygiene.

- Because of our new awareness of how much we depend on foreign companies for vital products, more manufacturing will be done here.

- New industries will be created and more jobs and business opportunities will result from this crisis.

If you have been considering buying or selling a business, the stars are lining up, interest rates are low, and the U.S. government will be putting extra efforts into economic stimulus. Gas prices are very low, and people will have more money to spend in local businesses. The list goes on. If you have been waiting for the right time to buy or sell a business, that time is now. It sometimes takes months to close a deal, by that time the virus will be history, and businesses will beginning to flourish again!

Read More

Finding the Best Business for You

Owning a business and owning the right kind of business for you are, of course, two wildly different things. Owning the wrong kind of business can make you absolutely miserable. So if you are considering buying a business, it is prudent that you invest the time and effort into determining the best kind of business for your needs and your personality. In a recent Forbes article, “What is the Right Type of Business for You to Buy?” author Richard Parker explores how buyers should go about finding the right business fit.

Parker is definitely an expert when it comes to working with buyers as he has spoken with an estimated 100,000 buyers over his career. In that time, Parker has concluded that it is critical that you don’t “learn on your own time.”

His key piece of advice concerning what type of business to buy is as follows. “While there are many factors to be considered, the answer is simple: whatever it is you do best has to be the single most important driving factor of the revenues and profits of any business you consider purchasing.” And he also believes that expertise is more important than experience. Parker’s view is that it is critical for prospective buyers to perform an honest self-assessment in order to identify their single greatest business skill and area of expertise. The last thing you want to do is pretend to be something that you are not.

Parker makes one very astute point when he notes, “Small business owners generally wear many hats: this is usually why their businesses remain small. Remember that every big business was once a small business.” As Parker points out, whoever is in charge of the business will ultimately determine how the business will evolve, or not evolve. Selecting the right business for you and your skillsets is pivotal for the long-term success of your business.

All of this adds up to make the process of due diligence absolutely essential. Before buying a business, you must understand every aspect of that business and make certain that the business is indeed a good fit for you. According to Parker, if you don’t love your business, it will have trouble growing. This point is impossible to refute. Owning and growing a business requires a tremendous amount of time and effort. If you don’t enjoy owning and/or operating your business, success will be a much more difficult proposition.

Finding the right business for you is a complicated process even after you have performed a proper evaluation of your skills and interests. After all, do you really want a solid business with great potential for growth that you would hate owning? By working with brokers and M&A advisors, you can find the best business fit for your needs, personality, and goals. These professionals are invaluable allies in the process of discovering the right business for you.

Copyright: Business Brokerage Press, Inc.

The post Finding the Best Business for You appeared first on Deal Studio – Automate, accelerate and elevate your deal making.